Bitcoin Price in 2025: Latest Trends, Market Analysis, and Future Predictions for BTC and Crypto Market

The cryptocurrency market has always been a rollercoaster, and 2025 is no exception. Bitcoin (BTC), the flagship cryptocurrency, continues to dominate headlines with its volatile price movements, regulatory developments, and market trends. In this article, we’ll dive deep into the latest Bitcoin price trends, analyze the factors influencing the crypto market, and provide insights into what the future holds for BTC and other cryptocurrencies like Dogecoin.

Bitcoin Price: Current Trends and Market Analysis

As of February 2025, Bitcoin’s price has been experiencing significant volatility. After reaching an all-time high of $109,588 in January, BTC has faced downward pressure, dropping to around $93,000 in early February. This decline is attributed to several factors, including geopolitical tensions, regulatory concerns, and macroeconomic developments.

Key Factors Influencing Bitcoin Price in 2025

- Geopolitical Tensions and Trade Wars:

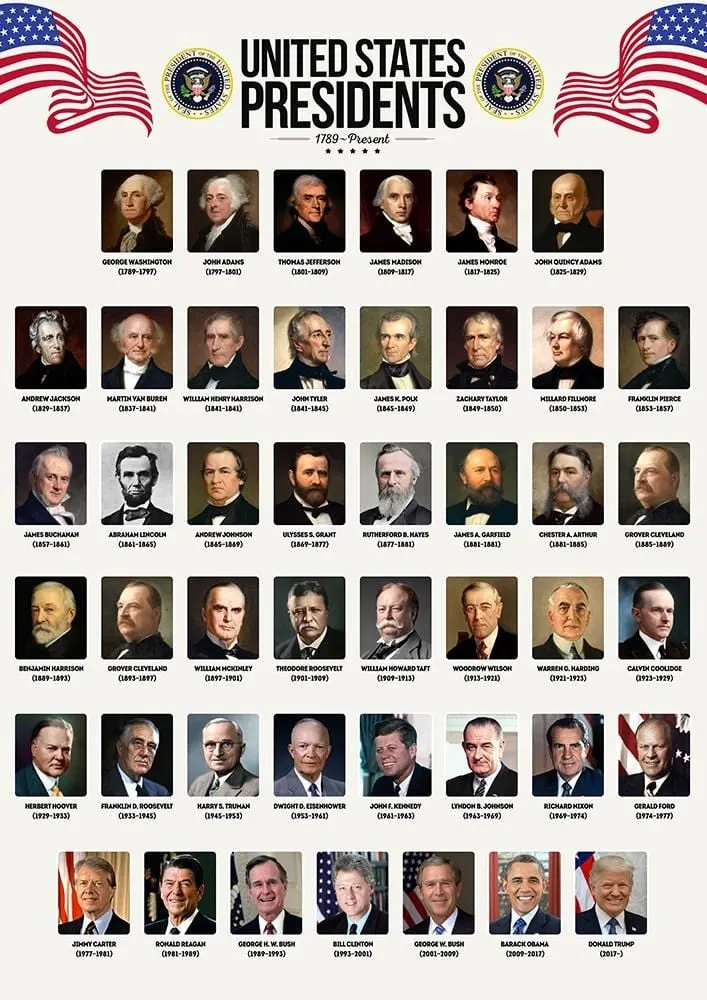

- The imposition of tariffs by the U.S. under President Donald Trump has sparked fears of a global trade war. Countries like Canada and Mexico have retaliated with their own tariffs, creating uncertainty in global markets. This has led to a risk-off sentiment, impacting Bitcoin and other risk assets.

- Regulatory Developments:

- The Federal Reserve’s recent announcement allowing banks to offer crypto services has been a game-changer. However, concerns over stricter regulations in other regions, such as Europe and Asia, have added to market uncertainty.

- Macroeconomic Factors:

- The U.S. Federal Reserve’s decision to pause interest rate cuts has also influenced Bitcoin’s price. Higher interest rates typically reduce the appeal of riskier assets like cryptocurrencies.

- Market Sentiment and Investor Behavior:

- Bitcoin’s price is heavily influenced by market sentiment. The recent drop in BTC dominance, coupled with a surge in altcoin activity, indicates a shift in investor focus. However, long-term holders (LTHs) continue to hold their BTC, reducing selling pressure and supporting price stability.

Bitcoin Price Predictions for 2025

Despite the recent drop, analysts remain optimistic about Bitcoin’s long-term prospects. Here are some key predictions for BTC in 2025:

- Bullish Outlook:

- Many analysts predict that Bitcoin could reach $120,000 by the end of 2025. This optimism is fueled by the upcoming Bitcoin halving event, which historically triggers a bull run.

- Bearish Scenarios:

- If Bitcoin fails to hold key support levels, such as $90,000, it could drop further to $85,000. This would delay the anticipated upward momentum.

- Institutional Adoption:

- The approval of spot Bitcoin ETFs and increased institutional interest are expected to drive demand for BTC, supporting its price in the long term.

Crypto Market Overview: Beyond Bitcoin

While Bitcoin remains the dominant cryptocurrency, the broader crypto market has seen significant activity in 2025. Here’s a look at some key trends:

- Dogecoin (DOGE):

- Dogecoin, the meme-inspired cryptocurrency, has experienced a sharp decline in early February, dropping by over 10%. This is largely due to the overall market downturn and reduced retail investor interest.

- Altcoin Capitulation:

- Many altcoins have seen significant losses as Bitcoin dominance nears a 4-year high. This trend indicates a shift in investor focus back to BTC, reducing the appeal of smaller cryptocurrencies.

- Stablecoins and DeFi:

- Stablecoins like USDT and USDC continue to play a crucial role in the crypto ecosystem, providing liquidity and stability. Meanwhile, decentralized finance (DeFi) platforms are gaining traction, offering innovative financial solutions.

Crypto News Today: What’s Happening in the Market?

Here are some of the latest developments in the crypto space:

- Tether on the Lightning Network:

- Tether (USDT) has announced plans to integrate with the Bitcoin Lightning Network, enhancing transaction speed and scalability.

- Bitcoin ETFs:

- U.S. spot Bitcoin ETFs have seen significant inflows, with analysts predicting over $50 billion in investments by the end of 2025.

- Regulatory Updates:

- The European Union’s Markets in Crypto-Assets (MiCA) regulation is set to take effect, bringing clarity and stability to the European crypto market.

Conclusion: What’s Next for Bitcoin and the Crypto Market?

The Bitcoin price in 2025 remains a topic of intense speculation and analysis. While short-term volatility is expected, the long-term outlook for BTC and the broader crypto market remains positive. Factors such as institutional adoption, regulatory clarity, and technological advancements will play a crucial role in shaping the future of cryptocurrencies.

For investors, staying informed and conducting thorough research is essential. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding the market dynamics and trends is key to making informed decisions.

External Links for Further Reading

- Forbes: The Fed’s Crypto Game-Changer

- CoinDesk: Bitcoin Price Analysis

- FXStreet: Bitcoin Price Predictions

- BeInCrypto: Crypto Market Trends

- Glassnode: On-Chain Data Analysis

By staying updated with the latest news and trends, you can navigate the ever-changing world of cryptocurrencies with confidence.