Bitcoin Price Crash: Why BTC is Dropping and What It Means for the Crypto Market

Introduction: The Turbulent Landscape of Bitcoin in 2025

In February 2025, the cryptocurrency market is experiencing a period of unprecedented volatility. Bitcoin (BTC), which traditionally leads the crypto market, has seen a dramatic decline in value. This downturn is not isolated but part of a broader crypto crash impacting various digital assets and causing widespread concern among investors.

Historically viewed as a hedge against inflation and market uncertainty, Bitcoin is now under intense scrutiny as emerging macroeconomic challenges, record ETF outflows, and heightened security risks converge. This article provides an exhaustive analysis of why BTC is dropping, the influence of the Fear and Greed Index, detailed insights from CoinMarketCap, and technical aspects of the BTC/USD trading pair. In doing so, readers gain a robust understanding of the factors driving current market trends and actionable insights to navigate the volatile crypto environment.

Why is Bitcoin Dropping?

Bitcoin's current price crash is the result of multiple converging factors. Analyzing these drivers offers clarity on market behaviour and investor sentiment during periods of stress.

Macroeconomic Pressures and Global Uncertainty

Recent economic turmoil has affected markets worldwide. Heightened inflation, aggressive monetary policies by central banks, and ongoing geopolitical disputes have all contributed to a climate of uncertainty. Bitcoin, like many risk assets, reacts to:

Global Trade Tensions and Recession Fears

Increasing global trade tensions, particularly between major economies, have created an environment where investors seek liquidity and safety. With fears mounting over possible economic slowdowns or even recessions, risk-on assets such as crypto are experiencing pressure. This phenomenon is amplified by investors strategically shifting away from volatile markets to reduce exposure during these uncertain times.

Impact on Risk Assets

Traditionally, assets that carry higher risk profiles, including BTC, have been more sensitive to external shocks. Recent data indicate that the sell-off in cryptocurrencies is part of a broader retreat from high-risk investments, with investors reallocating capital into more stable instruments such as government bonds and blue-chip stocks. The interconnectedness of the global economy means that regulatory and economic shocks reverberate through all asset classes, making the crypto market particularly vulnerable.

Record ETF Outflows and Institutional Dynamics

Institutional adoption of Bitcoin and crypto products had reached a pinnacle in recent years. However, record outflows from Bitcoin ETFs in February 2025 signal a shift in sentiment.

Bitcoin ETF Withdrawals

Data from leading financial platforms reveal that over $3.4 billion has been withdrawn from Bitcoin ETFs this month alone. Such significant outflows are a stark indicator of diminishing confidence among institutional investors. A majority of trading algorithms and hedge funds have started recalibrating their risk models, anticipating further downside in the BTC/USD pair.

Consequences for Market Liquidity

This mass exit not only reduces the available liquidity of Bitcoin on traditional exchanges but also intensifies downward pressure on prices. Institutional players, who hold large positions, are often the last line of support during crises. Their retreat sends a powerful signal to retail investors that market fundamentals may be deteriorating further.

Heightened Security Concerns

Security remains a critical factor affecting investor sentiment in the cryptocurrency space. Recent cyberattacks and hacks have had considerable implications on market dynamics.

Exchange Vulnerabilities

A high-profile hacking incident involving the Bybit exchange has further shaken confidence in digital asset security. Such breaches expose vulnerabilities within the exchange infrastructure and create a ripple effect across the broader crypto environment. Investors, already jittery from economic uncertainty, may react disproportionately to security incidents.

Investor Confidence and Market Sentiment

When security concerns come to the forefront, panic selling can exacerbate market declines. Elevated risks in safeguarding digital assets deter both new and existing investors, leading to a vicious cycle of reduced participation and intensified price drops. The interplay of security risks and macroeconomic factors creates a doubly challenging scenario for Bitcoin and other cryptocurrencies.

The Broader Crypto Crash: Market-Wide Implications

Bitcoin’s plunge forms part of a more extensive market correction that is affecting numerous digital assets. Real analysis of these trends provides insights into the overall ecosystem.

Altcoin Performance in a Declining Market

Ethereum and Solana Under Pressure

Leading altcoins, notably Ethereum (ETH) and Solana (SOL), have followed Bitcoin's downward trajectory. Ethereum has seen a year-to-date decline of approximately 27.5%, while Solana's valuations have dropped by nearly 25.9%. These percentages underscore a loss of confidence not only in Bitcoin but across the crypto asset class. The performance of these altcoins is critical because they represent a significant share of the digital economy.

Diversification and Market Fragmentation

While Bitcoin’s decline is often highlighted, the fall in altcoin values indicates widespread market distress. Reduction in the overall crypto market capitalisation—now falling below $3 trillion for the first time in recent analysis—reflects a domino effect that is impacting diversified and speculative portfolios alike.

Market Capitalisation Dynamics

Shifting Dominance

Bitcoin’s once-dominant position in the cryptocurrency landscape is seeing erosion. Recent analyses highlight that Bitcoin’s market dominance has dropped from 48% to approximately 42% since the beginning of the year. This shift implies that investors are either seeking refuge in alternative digital assets or exiting the crypto market entirely.

The Implications of Declining Market Cap

The falling market capitalisation not only represents lower investor confidence but also signals liquidity issues that might persist if more market participants choose to withdraw. A reduced market cap may further discourage new entrants, as the risk-to-reward ratio worsens in such volatile conditions.

The Role of the Fear and Greed Index

Measuring Market Emotion

The Fear and Greed Index is a widely recognised tool that aggregates various market signals—including volatility, trading volume, and social media sentiment—to quantify investor emotions on a scale from 0 (extreme fear) to 100 (extreme greed). An index value of 21 currently reflects an environment dominated by fear.

Impact on Trading Behaviour

Historical patterns indicate that extremely low values on the Fear and Greed Index often precede periods of market reversal; however, the prevailing macroeconomic uncertainties add complexity to these signals. While low index readings suggest that market sentiment may be oversold, the extent of the current forces at play may delay a recovery. For traders, this index acts as a barometer, but it must be interpreted within the context of broader economic conditions.

Comparing Historical Trends

During previous market corrections, instances of extreme fear have sometimes presented effective buying opportunities. Nevertheless, the current environment, characterised by multifactorial pressure points, suggests caution. Investors are advised to monitor the index closely to understand better if the prevailing sentiment is a temporary overreaction or a sign of more profound systemic issues.

In-Depth Bitcoin Price Analysis: BTC/USD Trends

Technical Analysis in a Volatile Market

Current Price Metrics and Key Levels

As of late February 2025, Bitcoin is trading around $83,000—a significant drop from the earlier peak of $110,000 reached in January. Technical analysts observe that the current setup is reminiscent of an ascending broadening wedge, indicating potential weakness if the trend continues. The critical support level appears to be around $70,000. Breaching this level could trigger a cascade of further price declines.

Support and Resistance Dynamics

In technical analysis, support levels are key price points where buyers tend to enter the market. For Bitcoin, technical charts suggest that the $70,000 mark is a psychological and technical barrier. Conversely, resistance levels, such as those near previous highs around $110,000, remain strong hurdles to an upward reversal. Investors using technical analysis must watch these levels closely to gauge market sentiment.

The Role of Volume in Confirming Trends

Trading volume greatly influences the reliability of technical indicators. Recent reports from major exchanges indicate decline in trading volumes. A lower volume during price declines amplifies the risk of a steep downward spiral, as it suggests that the market lacks substantial buying interest to offset the selling pressure.

BTC/USD Pair: A Closer Look at Market Liquidity

Exchange Activity and Trading Outflows

The BTC/USD trading pair is a cornerstone of crypto markets. Major exchanges like Binance and Coinbase have reported record outflows, which are not only contributing to the volatility but also signalling reduced market liquidity. When liquidity is low, even minor market orders can lead to significant price swings, making technical analysis more challenging.

Historical Comparisons and Future Projections

Historically, Bitcoin has rebounded from steep declines, yet the current market conditions are unprecedented. Analysts reference past corrections where fear peaked before stabilisation occurred; however, today's complex interplay of macroeconomic factors, ETF withdrawals, and security scares suggests that Bitcoin could remain under pressure for an extended period. Future projections must consider both technical patterns and external economic stimuli, making a swift recovery less likely in the short term.

Implications for Day Traders and Long-Term Investors

For day traders, the high volatility in the BTC/USD pair provides both opportunities and challenges. Quick in-and-out strategies might yield profits, but the risk associated with unpredictable price swings is considerably elevated. Long-term investors, conversely, need to consider diversifying their portfolios and balancing risk exposure, given the current uncertain outlook.

Insights from CoinMarketCap Data

Detailed Analysis of Trading Activity

Declining Trading Volumes

Data aggregated by CoinMarketCap reveals that trading volumes for Bitcoin have seen a marked decline over recent weeks. Reduced activity on exchanges often precedes further downward pressure on prices because it suggests that either buyers or sellers are absent from the market. This absence can exacerbate price drops when institutional investors move to exit positions rapidly.

Market Dominance and Investor Behaviour

As mentioned earlier, Bitcoin’s market dominance has fallen from nearly 48% to 42%. This shift is important because it provides insight into how investor attention is being reallocated. Although Bitcoin remains the bellwether of the crypto market, lower dominance can be interpreted as a sign that market participants are either hedging their risk preferences or shifting focus to a wider basket of digital assets.

Exchange Outflows and Liquidity Concerns

Record withdrawals from major exchanges have been documented, indicating that liquidity in the market is slipping away. The trend of increasing outflows not only hinders immediate trading efforts but also serves as a signal that institutional players may be repositioning their portfolios away from Bitcoin. For investors relying on CoinMarketCap data to inform their decisions, these developments underscore the need for caution.

Understanding the Fear and Greed Index

An Indicator of Investor Sentiment

What Does the Index Represent?

The Fear and Greed Index provides a quantitative measurement of the emotional state of the cryptocurrency market. An index reading close to 0 represents extreme fear, while values near 100 indicate extreme greed. Currently, at a value of 21, the index signals that panic and uncertainty dominate, significantly impacting market behaviour.

Factors Influencing the Index

The calculation of the index integrates multiple factors such as:

- Market volatility indicators

- Trading volumes on major exchanges

- Trends in social media sentiment

- Survey data from crypto investors

These multiple data sources come together to provide a composite view of market sentiment, and the present low value suggests that there is sustained pressure on Bitcoin and other cryptocurrencies from an emotional as well as technical standpoint.

Historical Cases and Present-Day Comparisons

In the past, when the index has reached similarly low levels, opportunistic investors have entered the market en masse, prompting a rebound. However, the current backdrop of global economic instability, coupled with heightened security concerns, means that sentiment-driven rebounds may be delayed or follow a more prolonged period of stagnation.

Additional Factors Impacting the Crypto Market

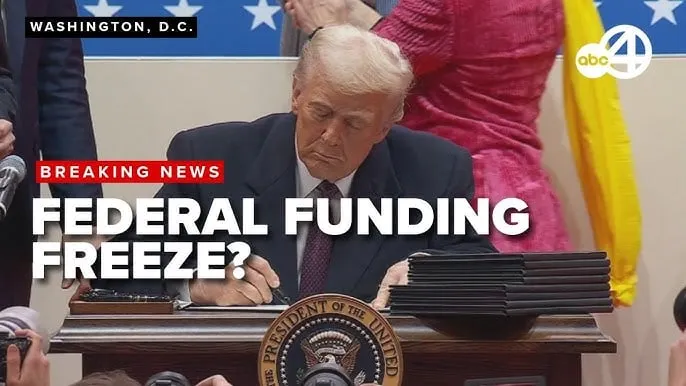

Regulatory Developments and Government Policies

Increased Scrutiny and Compliance Measures

Regulatory bodies worldwide are intensifying their focus on cryptocurrencies. New compliance measures and regulatory frameworks introduced in major economies have prompted some institutional investors to re-assess their exposure to digital assets. The regulatory uncertainty, especially in jurisdictions with strict financial controls, has contributed to increased volatility and a lack of confidence among market participants.

Impact on Liquidity and Market Stability

Stricter regulations, particularly those affecting ETF structures and exchange operations, have compounded liquidity challenges. In an environment where regulatory announcements can cause immediate sell-offs, market stability becomes a critical concern for both retail and professional investors.

Global Liquidity and Investor Sentiment

Shifts in Investment Strategies

Global liquidity conditions have forced investors to reallocate capital, often moving away from volatile assets like BTC towards more stable investment vehicles. This reallocation has had a pronounced effect on digital asset prices, as the available capital to absorb negative sentiment diminishes.

The Role of International Markets

Investor sentiment in international markets also plays a role in Bitcoin’s price trajectory. A weakening dollar, coupled with economic uncertainties in Europe and Asia, has contributed to a global retreat from risk assets. Such dynamics create a context in which digital assets, regardless of their pioneering role, are no longer insulated from global economic turbulence.

Actionable Takeaways for Navigating the Current Crypto Environment

Diversification and Risk Management

Rebalance Your Investment Portfolio

In light of the downward pressure on BTC and other cryptocurrencies, a diversified approach is more crucial than ever. Investors should consider a mix of traditional assets, including stocks, bonds, and precious metals, to mitigate risk. Diversification can cushion portfolios against sharp downturns in any single asset class.

Monitor Key Technical and Sentiment Indicators

Keeping a close eye on technical metrics, such as support and resistance levels, along with sentiment indicators like the Fear and Greed Index, is vital. Regular monitoring of these metrics through platforms like CoinMarketCap can help in identifying potential market turning points, thus enabling investors to make timely decisions.

Staying Informed and Strategically Positioned

Engage with Reliable Sources

Staying abreast of market developments through credible financial news outlets and aggregators is essential. Websites such as CoinMarketCap and the Fear and Greed Index offer valuable real-time data. Such platforms can provide early warnings of market shifts and offer deeper insights into trading volume and liquidity trends.

Consider Long-Term Versus Short-Term Positioning

For long-term investors, understanding historical patterns of recovery may prove beneficial. Despite current market stress, historical trends have shown that Bitcoin often recovers from downturns. A careful balance between taking profits in the short term and maintaining positions for long-term growth is recommended.

Develop a Tactical Exit and Entry Strategy

Traders should have a clear plan for exiting losing positions and capitalising on potential market rebounds. Given the current volatility, stop-loss orders and position-sizing strategies are invaluable tools for safeguarding against unexpected price movements.

Conclusion: Navigating the Road Ahead

Bitcoin’s dramatic price crash and the ensuing crypto crash underscore the fragility of digital asset markets in the face of global economic challenges. The simultaneous impact of macroeconomic pressures, institutional ETF outflows, security concerns, and declining trading volumes present a complex landscape for investors.

The current state of the market, as evidenced by the Fear and Greed Index reading of 21 and the continued decline in market capitalisation, indicates short-term uncertainty. However, historical trends suggest that periods of extreme market pessimism may eventually give way to recovery. Investors are encouraged to remain vigilant, diversify their portfolios, and keep a long-term view amidst the prevailing turbulence.

Actionable Insights and Recommendations

For those navigating this turbulent environment, the following steps are recommended:

• Recognise the importance of diversification—allocate risk across multiple asset classes to shield your portfolio.

• Monitor technical indicators such as the BTC/USD support levels around $70,000, and track market sentiment through trusted measures like the Fear and Greed Index.

• Remain informed by regularly consulting platforms like CoinMarketCap and the Fear and Greed Index.

• Develop a tactical investment strategy that includes clearly defined entry and exit points, especially if market volatility continues.

By adopting a measured approach, investors can mitigate potential losses and position themselves favourably for eventual market recovery. The present crisis, while signalling short-term risks, also may offer opportunities for long-term strategic investment in Bitcoin and other prominent cryptocurrencies once market fundamentals stabilise.

External Links for Further Reading

• CoinMarketCap: Essential for tracking real-time market data and trading volumes.

• Fear and Greed Index: Provides a snapshot of investor sentiment across the crypto market.

• FX Leaders Bitcoin Analysis: Offers technical insights and market predictions for Bitcoin and other cryptocurrencies.

• Forbes Digital Assets Section: For broader economic insights affecting the crypto market.

Final Thoughts

This in-depth analysis on Bitcoin’s recent price crash, the widening crypto crash, and the role of key metrics like the Fear and Greed Index provides a comprehensive view of current market dynamics. While uncertainty prevails, the historical resilience of Bitcoin suggests that well-informed, strategic investments could yield significant rewards as the market rebalances.

Investors are advised to use the actionable takeaways provided, maintain a diversified portfolio, and follow trusted external sources for ongoing updates. As always, a careful analysis of both quantitative data and qualitative signals will be crucial to navigating these turbulent times.