Canadian Dollar Trends in 2025: Impact of US Tariffs, Economic Outlook, and Exchange Rate Analysis

The Canadian dollar (CAD) has been under significant pressure in 2025, with its performance against the US dollar (USD) drawing widespread attention. This article delves into the latest trends, key drivers, and future outlook for the Canadian dollar, focusing on its relationship with the US dollar, the impact of US tariffs, and broader economic factors.

Canadian Dollar vs. US Dollar: A Volatile Relationship

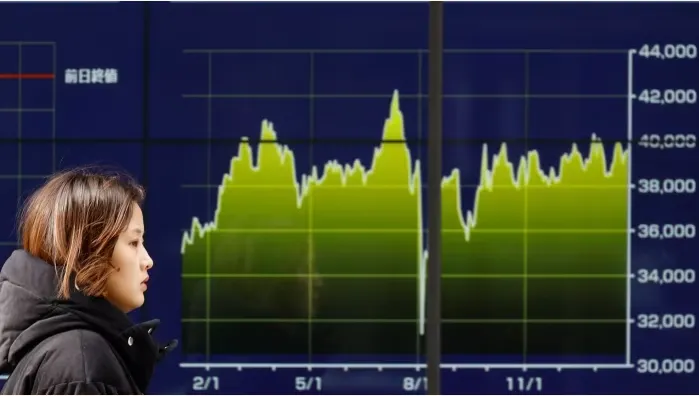

The USD/CAD exchange rate has been a focal point for investors and economists in 2025. The Canadian dollar has experienced a sharp decline, reaching near five-year lows against the US dollar. As of February 2025, the exchange rate stands at approximately 1.43 CAD per USD, reflecting a 7.9% depreciation in 2024 alone.

Key Drivers of the CAD Decline:

- US Tariffs: The threat of US tariffs on Canadian goods, particularly oil and automobiles, has weighed heavily on the loonie. President Donald Trump’s administration has repeatedly hinted at imposing tariffs, creating uncertainty in the market.

- Interest Rate Divergence: The Bank of Canada (BoC) has cut its benchmark interest rate to 3.25%, while the US Federal Reserve maintains a higher rate range of 4.25%-4.50%. This divergence has made the US dollar more attractive to investors.

- Economic Slack: Canada’s economy has shown signs of weakness, with high unemployment and slower GDP growth compared to the US.

Impact of US Tariffs on the Canadian Dollar

The looming threat of US tariffs has been a significant factor in the Canadian dollar’s decline. Canada exports approximately 75% of its goods to the US, making it highly vulnerable to trade restrictions.

Potential Scenarios:

- Tariff Implementation: If the US imposes tariffs, the Canadian dollar could weaken further, potentially reaching 1.50 CAD per USD by the end of 2025.

- Short-Term Impact: Analysts predict that the initial impact of tariffs would be severe but short-lived, with the loonie recovering as clarity emerges on trade policies.

- Long-Term Outlook: A resolution to the trade dispute could stabilize the Canadian dollar, but prolonged uncertainty may continue to weigh on its value.

Bank of Canada’s Role in the Currency’s Performance

The Bank of Canada has played a crucial role in shaping the Canadian dollar’s trajectory. In 2024, the BoC cut its policy rate by 175 basis points to support the economy, compared to the US Federal Reserve’s 75 basis points reduction.

Key Points:

- Monetary Policy Easing: Lower interest rates have made the Canadian dollar less attractive to investors, contributing to its depreciation.

- Inflation Control: Despite the rate cuts, inflation in Canada remains close to the BoC’s 2% target, providing some stability.

- Future Rate Cuts: Analysts expect the BoC to continue easing monetary policy in 2025, further pressuring the loonie.

Economic Outlook for Canada in 2025

Canada’s economic growth is projected to rise to 1.8% in 2025, outpacing potential output. However, the threat of US tariffs and slower population growth pose significant risks.

Key Economic Indicators:

- GDP Growth: Supported by past interest rate cuts and increased export capacity, GDP growth is expected to strengthen.

- Inflation: Inflation is forecast to remain close to the BoC’s target, with shelter inflation gradually easing.

- Trade Balance: The increased transport capacity for oil and gas, including the Trans Mountain pipeline, is expected to boost exports.

Canadian Dollar Forecast for 2025

Analysts predict that the Canadian dollar will recoup some of its losses in 2025, but its upside will be limited by US tariff risks and economic uncertainty.

Key Projections:

- Short-Term (3 Months): The loonie is expected to edge higher to 1.43 CAD per USD.

- Medium-Term (1 Year): The currency is forecast to strengthen to 1.3950 CAD per USD, reflecting a 3% increase.

- Long-Term (End of 2025): The USD/CAD exchange rate could narrow as the US dollar weakens, but the loonie’s recovery will depend on trade policy clarity and domestic economic performance.

Benefits of a Weaker Canadian Dollar

While the loonie’s decline has raised concerns, it also offers some advantages:

- Export Competitiveness: A weaker currency makes Canadian exports more attractive, potentially boosting trade.

- Investment Returns: Canadian investors benefit from higher returns when converting gains from USD-denominated securities back to CAD.

Conclusion: Navigating the Canadian Dollar’s Future

The Canadian dollar’s performance in 2025 will be shaped by a complex interplay of factors, including US tariffs, monetary policy, and economic growth. While the loonie faces significant headwinds, its long-term outlook remains cautiously optimistic. Investors and policymakers must remain vigilant to navigate the challenges ahead.

Important External Links:

- Bank of Canada Monetary Policy Report

- Reuters: Canadian Dollar Trends

- Morningstar: Canadian Dollar Outlook

- The Globe and Mail: Currency Analysis

- USD/CAD Exchange Rate Forecast

This article provides a comprehensive analysis of the Canadian dollar’s trends in 2025, offering valuable insights for investors, economists, and policymakers. Stay informed and make data-driven decisions in this dynamic financial landscape.