Denny's Closure Wave: In-Depth Analysis of Dozens of Locations Shutting Down Amid Strategic Restructuring

Denny Closing

Introduction

Few names in the American dining scene inspire as much nostalgia as Denny's. Known as a late-night haven and a fixture in roadside Americana, the chain has long symbolized the comfort of a 24/7 diner experience. However, amid shifting consumer behaviors and mounting economic pressures, the iconic Beloved Diner Chain is facing a transformative and challenging period.

In recent months, public disclosures and news reports have revealed that Denny's intends to close a significant number of its restaurants. This article provides an in-depth analysis of the unfolding events including the strategic Operational Restructuring, detailed Earnings Release insights, and the latest Investor Update. We will also discuss how these moves relate to broader trends in the American Restaurant Industry.

In this comprehensive exploration, we break down:

• The background of the announced Restaurant Closures and the rationale behind shuttering Dozens of Locations

• Fresh data from the company’s latest Earnings Release and statements made during their Investor Update

• How Operational Restructuring fits into the company's long-term strategy and the competitive landscape of the American Restaurant Industry

• External factors affecting the business including inflation, consumer trends, and weather-related challenges

• Actionable takeaways for investors, franchisees, and industry observers

────────────────────────────

The Legacy of Denny's and Shifting Market Dynamics

At its inception in 1953, Denny's was more than just a dining destination—it was an essential part of American culture. With its welcoming neon lights, endless coffee refills, and an expansive menu that catered to everyone from early risers to night owls, Denny's earned a special place as a Beloved Diner Chain across the United States. The brand’s legacy has been built on a promise of accessibility and the comfort of familiar food, making it a household name.

Over the decades, however, the restaurant landscape in America has experienced seismic shifts. The rise of fast-casual dining, increasing consumer preference for delivery and take-out services, and erratic economic cycles have forced many restaurant giants to reevaluate their operational blueprints. For Denny's, the current phase represents a confluence of market pressures and internal strategy reformations. This transformation is set against the backdrop of a broader trend in the American Restaurant Industry, where consolidation and closures have become common phenomena.

Recent reports indicate that following an initial announcement to shutter 150 locations by the end of 2025, new data suggests that the number of closures is set to rise further. In 2024, the chain closed 88 underperforming restaurants—and now additional closures are on the horizon. Some news outlets, including respected reports from outlets like NBC News, MSN, and CNN Business, highlight that Denny's now expects to close between 70 and 90 additional Dozens of Locations in the coming year.

These decisions are driven in part by shifting consumer preferences. As diners increasingly opt for fast-food and take-out options, many legacy locations struggling to meet modern standards are being re-evaluated. Location lease expirations and a determination to focus on profitable markets further accelerate the closures.

────────────────────────────

The Data Behind the Closures

A critical element of any major corporate decision is transparency through numbers. In its latest Earnings Release, Denny's provided key data points that illuminate the scope of their restructuring. Here are some salient facts:

- Last Year’s Closures:

- The chain closed 88 locations in 2024—a number that already surpassed many earlier projections. These closures were primarily aimed at underperforming units that had been open for decades, some for an average of 30 years.

- The 2025 Outlook:

- Initially, Denny's projected closing 150 locations by the end of 2025. However, due to the dynamic nature of market conditions, recent statements from CFO Robert Verostek indicate that the closure count could increase by an additional 30 locations. In effect, the chain is now earmarking between 70 and 90 closures in 2025, well above earlier estimates.

- Geographic Focus:

- The bulk of the closures are concentrated in regions where the diner has historically thrived—such as California, Texas, Florida, and Arizona. The rationale is straightforward: even in seemingly strong markets, the landscape has shifted due to factors such as lease expirations, diminishing foot traffic, and an evolving competitive environment.

- Shareholder Impact:

- From an investor perspective, these measures have not come without consequences. Denny's shares have seen significant fluctuations, with current trading values falling to around $5—down from a historic high of approximately $24 in 2019. This decline underscores the challenges that come with balancing legacy appeal and modern market demands.

The company's public disclosures during the latest Investor Update have been candid about the reasons behind these decisions. CFO Robert Verostek commented that “accelerating the closure of lower-volume restaurants will improve franchisee cash flow and allow reinvestment into traffic-driving initiatives such as our remodel program.” By reallocating resources to more profitable outlets and new openings, Denny's is positioning itself for long-term sustainability, even if it means dimming the neon lights at many long-standing locations.

For industry analysts and observers, these developments are not isolated. The response to shifting customer behaviors, high inflation rates, supply chain disruptions, and evolving dining preferences is being mirrored across many players in the American Restaurant Industry.

For further details on these numbers and commentary, refer to the full article on MSN’s business update and NBC News’ detailed update

────────────────────────────

Operational Restructuring: A Strategic Shift

At the heart of the closure decision lies a broader strategy encapsulated by Operational Restructuring. While the idea of shuttering nearly 150 restaurants may appear as a drastic measure, industry insiders explain that this is part of a deliberate strategy to reinvigorate the brand.

Key Dimensions of the Restructuring Strategy:

A. Portfolio Optimization

By focusing on higher-performing locations, Denny's intends to optimize its property portfolio. Older franchises that have not kept pace with modern consumer expectations are being handed over for closure. This consolidation is expected to free up capital, which can be reinvested in remodeling and marketing initiatives targeted at more dynamic markets.

B. Revitalization Through Remodels

The chain's efforts aren’t solely about pruning underperforming outlets; there is a significant push toward modernizing existing locations. The remodel program, as outlined by the CEO Kelli Valade during investor calls, is a foundational element of the strategy. Upgraded interior designs, updated menus, and improved customer service protocols are expected to drive up the average unit volume (AUV) at competing stores. Data shared in recent presentations indicated an incremental cost of roughly $250,000 per remodel—a strategic investment in rebranding and customer retention.

C. Balancing Closures with New Openings

Interestingly, while closures are the headline, Denny's is simultaneously planning new store openings. Insider reports reveal that around 25 to 40 new restaurants are slated to be added in the coming year. Approximately half of these new spots will be traditional Denny's outlets, while the rest will operate under the Keke’s Breakfast Cafe brand—a company acquired in 2022. This dual strategy of closing weaker franchises while investing in burgeoning markets represents a balanced approach to reshaping the business.

D. Supplier and Cost Management

In one of the most challenging aspects of running a large chain in today’s environment, Denny's is grappling with rising food costs and supply chain issues exacerbated by recent weather events (including California wildfires and severe snowstorms across the U.S.). CFO Verostek acknowledged that external pressures—from inflation to tariffs and even concerns like bird flu—have necessitated tighter supplier negotiations.

The goal is to ensure minimal disruptions as the company continues to restructure its operations while maintaining cost control.

For readers interested in a detailed financial breakdown and commentary on these initiatives, CNN Business has an insightful article covering these topics

────────────────────────────

Investor Update and Market Reactions

The sudden acceleration in closures generated considerable buzz among investors and market watchers. The latest Investor Update provided by Denny's management was not just a briefing on operational metrics—it was a strategic roadmap aimed at reassuring shareholders of a more sustainable future.

Major points from the Investor Update include:

• The acknowledgment of shifting consumer dynamics and the need to reallocate invested capital to high-growth avenues.

• Transparency over the decision process; closures are primarily focused on mature locations that have been operational for three decades or longer.

• An update on share performance, which has taken a hit, reflecting the uncertainty in the short term while suggesting potential long-term profitability improvements through the remodel program.

• Detailed mentions of steps being taken to improve franchisee cash flow, which subsequently will allow for reinvestments in areas that drive customer traffic.

Market reactions have been mixed. Some investors are wary, citing the high costs of remodeling and the temporary dip in operational capacity. Others appreciate the proactive measures, believing that by closing inefficient outlets, Denny's can focus more on its competitive strengths and safeguard its market reputation. For an alternative investor perspective, check out The Sun’s analysis .

These updates have critical implications for the wider American Restaurant Industry, especially for franchised chains with a long operational history. They highlight the delicate balance between honoring a legacy and adapting to modern market conditions.

────────────────────────────

External Factors Affecting the Diner Landscape

No business operates in a vacuum. While Denny's has its internal operational challenges, numerous external factors have contributed to the current state of affairs:

- Inflation and Consumer Behavior:

- The U.S. has seen an inflation uptick, with the annual rate hitting levels of around 3% according to the Bureau of Labor Statistics. This increase impacts consumer discretionary spending and has pushed many diners to opt for less expensive meal options or limit dining out altogether.

- Weather-Related Disruptions:

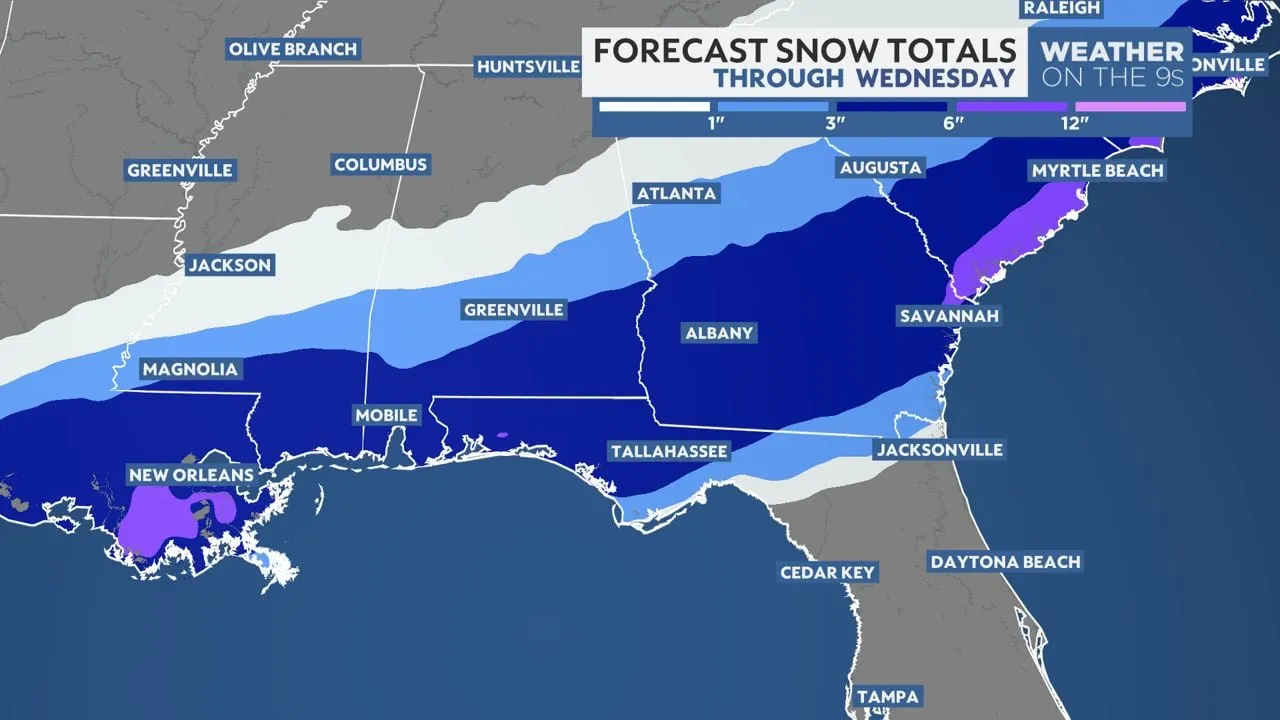

- Major weather events, such as wildfires in California and severe snowstorms nationwide, have disrupted not only supply chains but also the willingness of consumers to venture out, especially in areas where long-standing restaurants face these unpredictable situations.

- Shifting Preferences Toward Fast-Casual Dining:

- Across the country, consumers are increasingly favoring restaurants that offer fast-casual dining experiences. The promise of speed and convenience often outweighs the nostalgia of the classic diner experience. As a result, older brands like Denny's are forced to compete with nimble, modern establishments that can quickly adapt to changing tastes.

- Competition from Rival Chains:

- The industry is witnessing consolidation and transformation across the board. Other well-known names in the American Restaurant Industry such as Applebee’s, Outback Steakhouse, and Waffle House are all responding to similar pressures. For example, a recent report noted that Waffle House introduced a new surcharge on eggs amid soaring costs—a move reminiscent of broader cost-push behaviors across the sector.

These factors do not merely serve as background context; they critically inform the strategic decisions being made by the management team at Denny's. The confluence of rising costs, evolving consumer needs, and unpredictable market conditions has made it imperative for even the most storied names in dining to innovate and adapt.

────────────────────────────

Impact on the American Restaurant Industry

The ongoing shake-up at Denny's is emblematic of deeper trends within the American Restaurant Industry. With several major chains announcing closures, remodel programs, and new store investments, the industry appears to be undergoing a period of rapid recalibration. Here’s how the recent developments are influencing the broader landscape:

A. Consolidation and Market Efficiency

A significant trend evident across the restaurant sector is consolidation. By closing non-performing assets, chains like Denny's are effectively streamlining operations to focus on profitable geographies and market segments. This approach is likely to result in a more efficient distribution of capital, which, in turn, could lead to higher average unit volumes (AUVs) for the surviving outlets.

B. Driving Innovation Through Necessity

The forced operational changes are compelling long-established brands to innovate. Already, Denny's is not only investing in remodeling its stores but also experimenting with digital ordering platforms, loyalty programs, and partnerships that promise to enhance the overall customer experience. Such innovations are essential for retaining relevance in an industry where speed, technology, and personalization are increasingly prized.

C. Reinforcing the Franchise Model

For many chains, the franchise model remains a backbone for expansion and operational resilience. The recent Investor Update from Denny's emphasized improved cash flow for franchisees as a strategic priority. This indicates a shift towards a stronger franchisee support structure, ensuring that each location benefits from centralized operational improvements while maintaining local market agility.

D. Economic Resilience and Future Growth

Despite the short-term pressures, the overall outlook for the American Restaurant Industry remains cautiously optimistic. By strategically closing underperforming units and focusing investments on high-return opportunities, chains like Denny's aim to emerge leaner, more modern, and better positioned for the future. The broader industry, faced with similar challenges, may well follow suit in consolidating and upgrading their operational models.

For a broader industry perspective, the National Restaurant Association offers in-depth research and reports on emerging trends and economic forecasts that further contextualize these shifts.

────────────────────────────

Case Studies and Comparisons

To grasp the magnitude of Denny's restructuring, it is helpful to compare it with similar strategic moves by other chains in the American Restaurant Industry. Consider the following case studies:

Case Study 1: Applebee’s

Like Denny's, Applebee’s has faced declining foot traffic and sales in recent years. In response, Applebee’s initiated a mix of closures, remodels, and menu simplifications designed to better align the brand with contemporary dining preferences. Both chains have cited similar operational challenges such as high labor costs and changing consumer habits. The strategic focus on profitable core areas has proven essential for their survival and future growth.

Case Study 2: Outback Steakhouse

Outback has seen a similar pattern of consolidation, though with a sharper focus on international markets as well as domestic remodels. Like Denny's, Outback’s decisions were driven by the need to optimize unit performance. Both brands have invested heavily in store refurbishments and digital transformation initiatives to boost customer engagement. This parallel highlights that closures can be part of a broader, proactive strategy rather than an indicator of decline.

Case Study 3: Waffle House

Even the stalwart Waffle House, known for its resilient business model, has had to adjust to soaring costs and shifting consumer priorities. As reported by NBC, Waffle House recently introduced pricing adjustments in response to rising feed and egg prices. Such decisions mirror the cost management and supplier negotiations that Denny's is currently implementing as part of its Operational Restructuring.

These comparisons underscore that the trends witnessed at Denny's are not isolated. Instead, they represent a broader industry response to unprecedented economic and market pressures.

────────────────────────────

Data, Historical Trends, and Evidential Support

Data-driven decision-making is now more critical than ever, and recent figures shed light on the strategic recalibration by Denny's.

• Store Count Dynamics:

According to company data, Denny's ended 2024 with approximately 1,334 U.S. restaurants. With closures already accounting for 88 locations last year and a planned total of around 150 closures by the end of 2025, the footprint of the company is forecast to become increasingly concentrated in strong performing markets.

• Unit Volume Discrepancies:

The operational review shared during the Investor Update revealed that lower-performing stores averaged approximately $1.1 million in annual revenue, in stark contrast to top-performing outlets bringing in about $2.9 million. By closing units that lag behind, the overall system performance is expected to improve, bolstering the bottom line over the long term.

• Market Figures and Share Performance:

The share price dip—from highs of nearly $24 down to the $5 range—reflects investor concerns but also signals market adjustments in anticipation of improved future profitability. While the near-term volatility is a point of concern, such data points are essential to understanding the financial recalibration underway.

• Economic Indicators:

The broader economic backdrop, including a 3% annual inflation rate (as per the Bureau of Labor Statistics) and heightened supply chain challenges, reinforces the rationale behind these closures. Against this backdrop, Denny's strategy is to reallocated limited resources to areas with a higher return on investment.

These data points not only support the recent decisions made by management but also offer a roadmap for stakeholders across the American Restaurant Industry. For ongoing updates and statistical insights, industry publications such as Restaurant Dive and Bloomberg’s restaurant sector analysis provide robust coverage and analysis.

────────────────────────────

Actionable Takeaways and Practical Recommendations

For investors, franchisees, and even diners curious about the evolving landscape of this iconic brand, several key lessons can be drawn from Denny's current transformation:

- Strategic Consolidation Drives Long-Term Gains

- Companies that focus on closing underperforming locations can reallocate resources more effectively. Stakeholders should look for similar restructuring measures across the industry as signals of prudent management. The enhanced focus on high-performing outlets can lead to better service quality and financial robustness in the long run.

- Embrace Operational Overhaul

- Adapting to modern market conditions is not merely about reducing costs—it is about reinvesting wisely. Denny's robust remodel program hints at a future where locations are updated to meet contemporary demands. For franchise operators, investing in store refurbishments and leveraging digital platforms can revitalize legacy brands.

- Monitor External Economic Factors

- Given that rising inflation, supply chain issues, and extreme weather events are all affecting restaurant profitability, proactive risk management is essential. Both investors and management teams should factor in these external variables when planning expansion or contraction strategies.

- Stay Informed Through Credible Sources

- For those invested in or interested in the American Restaurant Industry, keeping up with regularly updated financial and sector-specific data is important. Resources such as the National Restaurant Association and major business news outlets like CNN Business and NBC News provide valuable insights.

- Analyze Franchise Model Adjustments

- The ongoing improvements in franchisee cash flow management and support structures signal a shift towards a more dynamic and resilient franchise model. For prospective franchisees or business partners, evaluating these operational enhancements can indicate long-term viability and profitability.

- Consider Consumer Trends

- As consumer preferences shift towards convenience and digital engagement, restaurants must evolve their service model. Operational changes that modernize ordering, digital loyalty programs, and streamlined menus are critical to staying competitive. Observers and stakeholders alike should assess whether brands are effectively addressing these trends.

────────────────────────────

Looking to the Future: What Lies Ahead for Denny's and the Industry

The current wave of closures at Denny's is not a harbinger of an end but rather a necessary evolution. In an era where consumer demand and market pressures are evolving rapidly, adaptation is key. While some long-time patrons may feel nostalgic about the closure of certain iconic locations, these measures have the potential to solidify the future of the brand by concentrating investment in areas that promise growth and sustainability.

For the broader American Restaurant Industry, Denny's serves as a case study in how even the most iconic institutions must sometimes transform radically to remain competitive. The dual approach of clearing out inefficient assets while simultaneously investing in new, promising opportunities could set a precedent for other legacy restaurant brands grappling with similar challenges.

By focusing on scalability, operational efficiency, and customer engagement, companies can weather challenging economic climates. The pressure to modernize, particularly in a post-pandemic environment where dining habits have changed significantly, is driving many players in the market.

As we look forward, expect to see more restaurant chains following similar reform strategies, blending practical operational changes with innovative customer service models.

────────────────────────────

Conclusion

In summary, the sweeping closures announced by Denny's reflect a bold, data-driven decision to adapt to both internal inefficiencies and external market challenges. The chain, known as a Beloved Diner Chain, is now strategically embracing Operational Restructuring that involves:

• Shuttering underperforming outlets across its network—resulting in the planned closure of between 70 and 90 restaurants in 2025

• Investing in a robust remodel program aimed at revitalizing its remaining stores

• Balancing closures with a select number of new openings to ensure sustained growth

• Addressing key external factors such as rising inflation, weather-related disruptions, and evolving consumer preferences

These events have not only adjusted the operational landscape of Denny's but have also offered broader insights into trends affecting the entire American Restaurant Industry. As brands recalibrate, investors and industry watchers should anticipate further consolidation and innovation across the sector.

────────────────────────────

Actionable Takeaways

- For Investors:

- • Monitor share performance and management’s quarterly earnings updates for signs of improvement post-restructuring.

- • Consider that short-term volatility may be balanced by long-term gains stemming from focused operational investments.

- For Franchisees and Operators:

- • Evaluate your current location’s performance—if your store has been open for decades with diminishing returns, consider the value of strategic upgrades or restructuring measures.

- • Stay abreast of technology and digital transformation strategies that can improve service delivery and operational efficiency.

- For Industry Observers:

- • Use the Denny's case to analyze broader trends in the restaurant business, such as consolidations and improved franchise support.

- • Keep informed by visiting reliable sources like the National Restaurant Association (https://restaurant.org) and major financial news outlets.

- For Diners:

- • Understand that while closures may signify the loss of a local icon, they are part of a necessary evolution to maintain quality and efficiency in a changing market.

────────────────────────────

Final Thoughts

The strategic closures and restructuring at Denny's represent a significant pivot in one of America’s most iconic diner chains. Learning from decades of tradition while adapting to modern market realities, the company’s proactive measures can inspire similar moves across the American Restaurant Industry. As the brand trims its portfolio and invests in upgrading high-performing locations, it sends a clear message: Adaptation is not only inevitable, but it is also essential in the face of evolving consumer trends and economic challenges.

The journey ahead for Denny's is one of transformation—balancing cherished heritage with innovative change. For industry stakeholders, franchisees, and even loyal patrons, these changes provide critical insights into how legacy brands can reinvent themselves in today’s competitive market.

────────────────────────────

Additional Resources

• MSN Money Report on Denny's closures:

• National Restaurant Association: https://restaurant.org

────────────────────────────

In-Depth Analysis Summary

This article has provided detailed insights into the rationale behind Denny's recent closures and how these decisions fit within a broader trend of operational prioritization within the American Restaurant Industry. By examining company data, market responses, and case studies from comparable brands, we have revealed how the combination of an extensive Earnings Release, proactive Operational Restructuring, and a transparent Investor Update form the bedrock of a strategic pivot. These changes show a clear effort to redefine profitability while responding to external pressures such as inflation, supply chain challenges, and changing consumer demands.

────────────────────────────

Final Recommendations

For those monitoring the dynamics of legacy brands in the dining sector, the key is to stay informed, review quarterly earnings updates, and follow strategic announcements from management. Whether you are an investor, a franchise operator, or simply a diner who cherishes the nostalgic vibe of classic American diners, the changes at Denny's underscore the importance of agility in business. Use this case as a springboard to deepen your understanding of how major brands evolve in response to macroeconomic trends and consumer behavior shifts.

────────────────────────────

Conclusion

The transformative period at Denny's is a microcosm of the challenges and opportunities facing the entire American Restaurant Industry. With consistent attention to data, a commitment to operational excellence, and strategic foresight in responding to market trends, legacy brands can reinvent themselves for a new era. The evolving story of closures, store remodels, and selective new openings at Denny's offers practical lessons and clear, actionable recommendations for all key stakeholders.

As the diner chain moves forward with underground closures and exciting new initiatives, its journey serves as a powerful example of how adapting to change can forge a path toward renewed strength and growth in an ever-evolving marketplace.

────────────────────────────

Key Points Recap

• Denny's is set to close between 70 and 90 additional locations in 2025—accelerating beyond the initial 150 planned closures.

• The closures target long-established, lower-performing outlets, while funds are redirected to a robust remodel program and selective new openings.

• The recent Earnings Release and Investor Update emphasize the strategic rationale for Operational Restructuring amid rising economic pressures.

• Broader trends in the American Restaurant Industry—including inflation, evolving consumer preferences, and intense competition—are shaping similar moves by other chains.

• Stakeholders across the board can draw practical lessons from Denny's approach, reinforcing the need for strategic adaptation, continuous innovation, and vigilant monitoring of market conditions.

────────────────────────────

Final Words

In facing industry disruptions head-on, Denny's is not merely contracting its footprint—it is strategically repositioning itself to thrive in a challenging period. For anyone with a stake in the evolution of the traditional diner model, this transformation is a call to action: embrace change, invest in quality, and prepare for a future where legacy meets innovation.

Stay informed, use reliable data, and let the lessons from Denny's transformation guide your next steps in navigating the dynamic world of American dining.

────────────────────────────

End of Article

By keeping abreast of detailed Investor Updates, listening to operational insights from key executives, and observing the broader economic landscape, you can better understand not only the fate of an iconic brand like Denny's but also the transformative trends shaping the American Restaurant Industry at large.

For further insights and continuous updates, bookmark the above external links and reputable industry sources.