Dow Futures Plunge in February 2025: Tariffs, Market Volatility, and What It Means for Investors

The financial markets have been rocked by significant developments in February 2025, with Dow Futures leading the charge in a downward spiral. This article delves into the latest trends in Dow Futures, stock futures, and the broader futures market, providing a comprehensive analysis of the factors driving these movements and what they mean for investors.

Dow Futures and Stock Futures: A Market in Turmoil

As of February 2025, Dow Futures have experienced a sharp decline, with futures attached to the Dow Jones Industrial Average tumbling by over 600 points. This downturn is largely attributed to the recent announcement by former President Donald Trump, who imposed 25% tariffs on Canada and Mexico, and 10% tariffs on China. These tariffs, set to take effect on February 4, 2025, have sent shockwaves through the global markets.

The S&P 500 futures and Nasdaq futures have also seen significant drops, with the S&P 500 futures spiraling by 1.6% and Nasdaq futures down by 2.4%. The tech-heavy Nasdaq Composite has been particularly hard hit, reflecting the market's sensitivity to geopolitical tensions and trade policies.

The Impact of Trump’s Tariffs on the Futures Market

The imposition of tariffs by Trump has had a profound impact on the futures market. The tariffs on Canada and Mexico, two of the United States' largest trading partners, have led to immediate retaliatory measures. Canadian Prime Minister Justin Trudeau announced "far-reaching" retaliatory levies, while Mexican President Claudia Sheinbaum imposed retaliatory tariffs on U.S. goods.

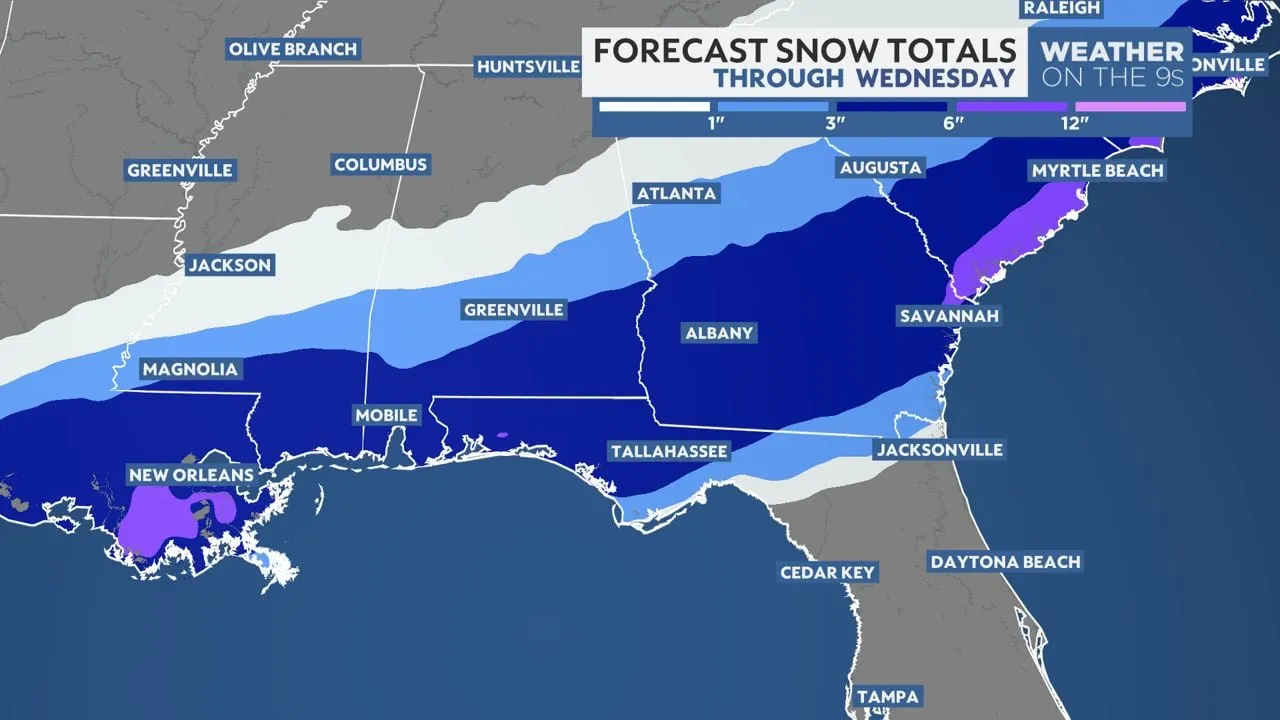

These developments have created a climate of uncertainty, with investors bracing for the potential fallout. The tariffs are expected to increase the cost of goods for American consumers, particularly in sectors such as agriculture, steel, and automotive. Economists warn that these measures could lead to higher inflation and slower economic growth.

Stock Market Crash Fears and Market Volatility

The sharp decline in Dow Futures has reignited fears of a stock market crash. The market volatility index (VIX) has surged, reflecting heightened investor anxiety. The heavy concentration of tech stocks in the S&P 500 has exacerbated the situation, with even minor hiccups in AI adoption or profitability leading to significant market swings.

The Federal Reserve's recent announcement of fewer interest rate cuts in 2025 has further contributed to market instability. Fed Chair Jerome Powell's decision to cut rates only twice, instead of the initially planned four times, has been met with mixed reactions. While some investors view this as a necessary measure to curb inflation, others fear it could stifle economic growth.

Gas Prices and Their Role in Market Dynamics

Gas prices have also played a role in the current market dynamics. The tariffs on Canada and Mexico are expected to impact the energy sector, with potential increases in gas prices. This could have a ripple effect across various industries, particularly those reliant on transportation and logistics.

Wall Street Journal and Market Analysis

The Wall Street Journal has been closely monitoring these developments, providing in-depth analysis and insights. According to the Journal, the current market conditions are reminiscent of previous periods of heightened volatility, such as the trade wars of the late 2010s. Investors are advised to remain cautious and consider diversifying their portfolios to mitigate risks.

Why Tariffs on Canada and Mexico?

The decision to impose tariffs on Canada and Mexico has been met with widespread criticism. Critics argue that these measures could harm the U.S. economy by increasing the cost of goods and disrupting supply chains. Proponents, however, believe that the tariffs are necessary to protect domestic industries and address trade imbalances.

The Role of the Mexican President

Mexican President Claudia Sheinbaum has been vocal in her opposition to the tariffs, vowing to take retaliatory measures. Her administration has emphasized the importance of maintaining strong trade relations with the United States, while also protecting Mexico's economic interests.

Key Takeaways for Investors

- Diversification is Key: In times of market volatility, diversifying your portfolio can help mitigate risks. Consider investing in sectors that are less impacted by global or tech-specific risks, such as healthcare or utilities.

- Stay Informed: Keep abreast of the latest developments in the futures market and geopolitical landscape. Reliable sources such as the Wall Street Journal and Forbes can provide valuable insights.

- Long-Term Perspective: While the current market conditions may be unsettling, it's important to maintain a long-term perspective. Historically, markets have recovered from downturns, and patient investors have been rewarded.

- Consult a Financial Advisor: If you're unsure about how to navigate the current market conditions, consider consulting a financial advisor. They can provide personalized advice based on your financial goals and risk tolerance.

External Links for Further Reading

- Wall Street Journal: Market Analysis

- Forbes: Stock Market Outlook for 2025

- CNBC: Latest Market Updates

- Federal Reserve: Interest Rate Decisions

- U.S. Bureau of Labor Statistics: Employment Data

Conclusion

The Dow Futures and broader futures market are currently navigating a period of significant volatility, driven by geopolitical tensions and trade policies. While the imposition of tariffs by Trump has created uncertainty, it also presents opportunities for informed investors. By staying informed, diversifying portfolios, and maintaining a long-term perspective, investors can navigate these turbulent times and position themselves for future success.

Note: This article is based on real-time data and analysis as of February 2025. For the latest updates, refer to the external links provided.