Ethereum Price Update: Current Trends and Future Outlook for ETH in 2025

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continues to be a focal point in the crypto market as we enter 2025. With its innovative blockchain technology and widespread adoption, Ethereum remains a key player in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. However, recent market fluctuations and competitive pressures have raised questions about its price trajectory. In this article, we’ll explore the latest Ethereum price trends, factors influencing its value, and what the future might hold for ETH.

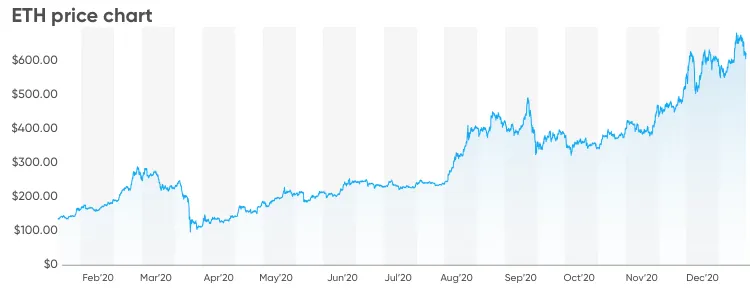

Current Ethereum Price Trends

As of January 20, 2025, Ethereum is trading at approximately $3,369, reflecting a 6.94% increase over the past 24 hours. This price recovery comes after a turbulent start to the year, during which ETH experienced significant volatility. Earlier this month, Ethereum faced a sharp decline, dropping below the critical $3,200 support level, which triggered liquidations worth $171 million, according to Coinpedia. This marked the largest liquidation event for Ethereum in 2025, highlighting the ongoing uncertainty in the crypto market.

Despite this setback, Ethereum has shown resilience, with its price rebounding from the lows of $3,020 recorded on January 13. The current market sentiment appears mixed, with a bullish outlook supported by increased trading volumes and technical indicators suggesting a potential reversal.

Factors Influencing Ethereum’s Price

Several factors are currently shaping Ethereum’s price movements:

1. Market Sentiment and Volatility

The broader cryptocurrency market has been experiencing heightened volatility in early 2025. Bitcoin, the market leader, has also seen significant price swings, which often influence Ethereum and other altcoins. The Fear & Greed Index for Ethereum currently indicates "Extreme Greed," suggesting that investor sentiment is cautiously optimistic.

2. Technical Analysis

Ethereum’s price chart shows a developing bullish reversal pattern, known as the "rounding bottom," on the weekly timeframe. This pattern is often interpreted as a signal of the end of a downtrend, with renewed buying interest from investors. Analysts predict that if Ethereum can break through its all-time high resistance of $4,864, it could confirm a new bull market.

3. Competition from Rival Blockchains

Ethereum continues to face stiff competition from other Layer-1 blockchains like Solana, Cardano, and Avalanche. These platforms offer faster transaction speeds and lower fees, which have attracted developers and users away from Ethereum. Solana, for instance, recently surpassed Ethereum in 24-hour trading volume on decentralized exchanges, according to The Motley Fool.

4. Adoption and Network Upgrades

Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism in 2022, known as "The Merge," has significantly reduced its energy consumption and increased its scalability. Upcoming upgrades, such as sharding, are expected to further enhance the network’s performance. These developments are likely to boost investor confidence and drive demand for ETH.

5. Macroeconomic Factors

Global economic conditions, including interest rate policies and inflation, also play a role in shaping cryptocurrency prices. As a speculative asset, Ethereum is sensitive to changes in investor risk appetite, which can be influenced by macroeconomic trends.

Ethereum Price Predictions for 2025

The outlook for Ethereum in 2025 remains cautiously optimistic, with analysts offering a range of price predictions:

- Short-Term Projections: According to CoinGape, Ethereum is expected to trade between $3,368 and $3,470 in January 2025, with a gradual upward trend throughout the year.

- Mid-Term Projections: Changelly predicts that Ethereum could reach an average price of $4,198 by the end of 2025, representing a 33% increase from its current levels.

- Long-Term Projections: Some analysts, including those at Benzinga, foresee Ethereum reaching as high as $8,700 in 2025, driven by increased adoption in DeFi, NFTs, and institutional investments.

While these predictions are promising, it’s important to note that cryptocurrency prices are inherently volatile and subject to rapid changes.

Is Ethereum a Good Investment in 2025?

Ethereum’s strong fundamentals and widespread adoption make it a compelling investment option for many. Here are some key points to consider:

Pros:

- Market Leadership: Ethereum remains the dominant platform for DeFi and NFTs, with a robust ecosystem of developers and users.

- Innovation: Ongoing upgrades, such as sharding, are expected to enhance Ethereum’s scalability and efficiency, making it more competitive.

- Institutional Interest: The approval of spot Ethereum ETFs in 2024 has increased institutional participation, providing a new source of demand for ETH.

Cons:

- Competition: Rival blockchains continue to challenge Ethereum’s market share, particularly in areas like DeFi and gaming.

- Volatility: Like all cryptocurrencies, Ethereum is subject to significant price fluctuations, which can pose risks for investors.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies could impact Ethereum’s adoption and price.

How to Invest in Ethereum

For those looking to invest in Ethereum, there are several options available:

- Cryptocurrency Exchanges: Platforms like Coinbase, Binance, and Kraken allow users to buy and sell Ethereum with ease.

- Decentralized Exchanges (DEXs): For more experienced users, DEXs like Uniswap and SushiSwap offer a way to trade Ethereum without intermediaries.

- Staking: Investors can earn rewards by staking their ETH on the Ethereum network, contributing to its security and operations.

It’s essential to conduct thorough research and consider your risk tolerance before investing in Ethereum or any other cryptocurrency.

Conclusion

Ethereum’s price journey in 2025 has been marked by both challenges and opportunities. While the cryptocurrency has faced headwinds from market volatility and competition, its strong fundamentals and ongoing network upgrades position it for long-term growth. As of now, Ethereum is trading at $3,369, with analysts predicting a potential upward trajectory in the coming months.

For investors, Ethereum remains a promising asset, but it’s crucial to stay informed about market trends and developments. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding the factors influencing Ethereum’s price can help you make informed investment decisions.

As always, remember that cryptocurrency investments carry risks, and it’s important to diversify your portfolio and invest only what you can afford to lose. With careful planning and a long-term perspective, Ethereum could be a valuable addition to your investment strategy in 2025 and beyond.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.