Federal Reserve Interest Rates Update: Key Insights from the Latest FOMC Meeting and Powell's Speech

The Federal Reserve's interest rate decisions are among the most closely watched economic events, influencing everything from mortgage rates to global financial markets. On January 29, 2025, the Federal Open Market Committee (FOMC) concluded its first meeting of the year, leaving interest rates unchanged. This decision comes amidst a backdrop of persistent inflation, a strong labor market, and political pressures. Here's a detailed breakdown of the latest developments, their implications, and what to expect in the coming months.

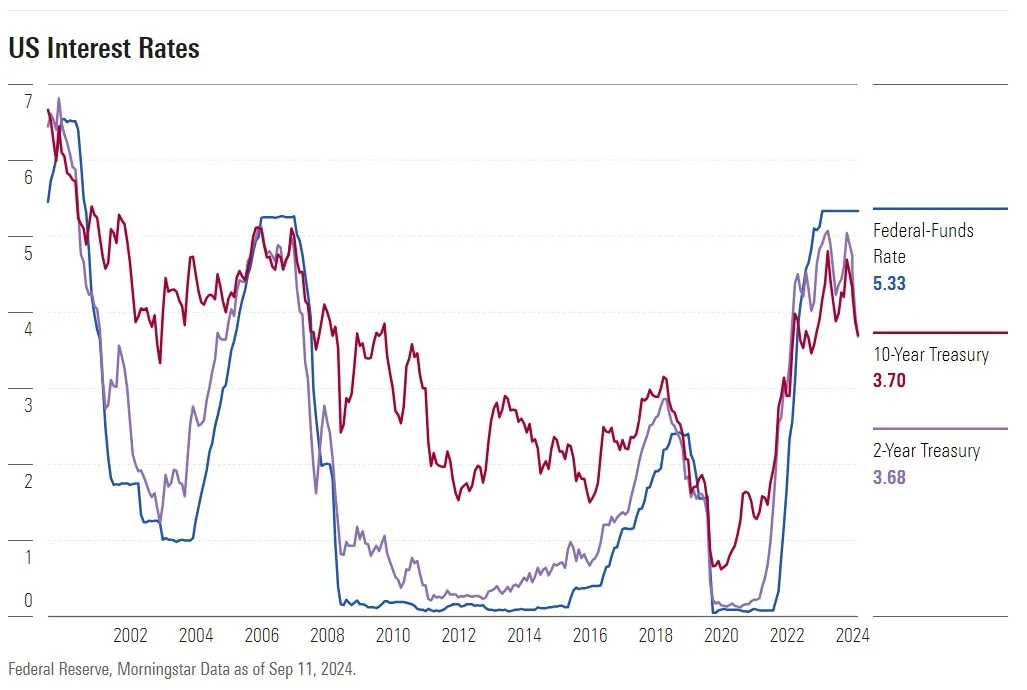

Federal Reserve Interest Rates: Current Status and Historical Context

The Federal Reserve's benchmark interest rate currently stands at a range of 4.25% to 4.50%, following three consecutive rate cuts in late 2024. These cuts marked a shift from the Fed's aggressive tightening cycle, which had pushed rates to a 20-year high of 5.25% to 5.50%.

The decision to pause rate changes in January 2025 reflects the Fed's cautious approach as it balances its dual mandate: maintaining maximum employment and achieving stable inflation at a target of 2%.

Why Did the Fed Pause Rate Cuts?

- Inflation Remains Elevated:

- Despite significant progress in reducing inflation from its 2022 peak of 9.1%, the latest Consumer Price Index (CPI) data shows inflation at 2.9% year-over-year in December 2024. Core inflation, which excludes volatile food and energy prices, remains higher at 3.2%, signaling persistent price pressures.

- Strong Labor Market:

- The U.S. unemployment rate stands at 4.1%, with robust job growth and nearly 8.1 million job openings as of November 2024. This tight labor market supports consumer spending but also risks fueling wage-driven inflation.

- Economic Growth:

- The U.S. economy grew by over 3% in the last two quarters of 2024, driven by steady consumer spending and business investments. This resilience reduces the urgency for further rate cuts.

Key Takeaways from the January 2025 FOMC Meeting

1. Fed Rate Decision

The FOMC unanimously voted to keep the federal funds rate unchanged at 4.25% to 4.50%. This decision aligns with market expectations, as indicated by the CME FedWatch Tool, which had priced in a 99.5% probability of no rate change.

2. Jerome Powell's Speech

Federal Reserve Chair Jerome Powell struck a cautious tone during his post-meeting press conference. Key highlights include:

- Inflation Outlook: Powell acknowledged recent improvements in inflation data but emphasized the need for sustained progress before considering further rate cuts.

- Economic Risks: He highlighted uncertainties stemming from potential policy changes under the Trump administration, including tariffs and immigration reforms, which could impact inflation and economic growth.

- Future Rate Cuts: Powell indicated that the Fed is not in a hurry to adjust its policy stance, suggesting that the next rate cut may not occur until mid-2025.

3. FOMC Statement

The FOMC's official statement removed language from its December release that suggested inflation had made progress toward the 2% target. Instead, it noted that inflation "remains somewhat elevated," reflecting a more cautious outlook.

Impact on Mortgage Rates and Borrowing Costs

The Fed's decision to hold rates steady means that borrowing costs for consumers and businesses will remain high in the near term. Here's how this affects key financial products:

1. Mortgage Rates

Mortgage rates, which are influenced by the Fed's policy, are expected to remain elevated. As of January 2025, the average 30-year fixed mortgage rate hovers around 6.5%, making homeownership less affordable for many Americans.

2. Credit Cards and Auto Loans

High interest rates on credit cards and auto loans continue to strain household budgets, particularly for lower- and middle-income families. Delinquencies on these loans have been rising, signaling financial stress.

3. Business Loans

For businesses, elevated borrowing costs could dampen investments and expansion plans, potentially slowing economic growth in the long run.

What to Expect from Future Fed Meetings

1. March 2025 FOMC Meeting

The next FOMC meeting is scheduled for March 19, 2025. While the Fed is unlikely to cut rates at this meeting, analysts will closely watch for any changes in the Fed's tone or economic projections.

2. Potential Rate Cuts in Mid-2025

Economists predict that the Fed may resume rate cuts by May or June 2025, provided inflation shows consistent improvement. The Fed's December 2024 projections indicated the possibility of two rate cuts in 2025, but this will depend on incoming data.

3. Key Economic Indicators to Watch

- Inflation Data: Monthly CPI and Personal Consumption Expenditures (PCE) reports will be critical in shaping the Fed's decisions.

- Labor Market Trends: Any signs of weakening in job growth or rising unemployment could prompt the Fed to act sooner.

- Global Economic Conditions: Geopolitical risks, trade policies, and global economic trends will also influence the Fed's outlook.

Political Pressures and the Fed's Independence

The Fed's decision-making process is facing increased scrutiny under the Trump administration. President Trump has publicly criticized Fed Chair Jerome Powell and called for immediate rate cuts to boost economic growth.

While Powell has reiterated the importance of the Fed's independence, political pressures could complicate the central bank's efforts to achieve its long-term goals.

Market Reactions to the Fed's Decision

Financial markets responded cautiously to the Fed's announcement:

- Stock Markets: Major indices closed lower on January 29, reflecting concerns about high borrowing costs and inflation risks.

- Bond Markets: Treasury yields remained stable, signaling that investors had largely anticipated the Fed's decision.

- Currency Markets: The U.S. dollar strengthened slightly against major currencies, supported by the Fed's cautious stance.

Conclusion: Navigating the Fed's Policy Landscape in 2025

The Federal Reserve's decision to pause rate changes underscores its commitment to data-driven policymaking. While inflation has moderated, it remains above the Fed's target, necessitating a cautious approach.

For consumers, businesses, and investors, the Fed's actions will continue to shape economic conditions in 2025. Staying informed about upcoming FOMC meetings, Powell's speeches, and key economic indicators will be crucial for navigating this complex landscape.

As the year unfolds, the Fed's ability to balance its dual mandate amidst political and economic uncertainties will be a defining factor in the U.S. economy's trajectory.

By staying updated on Federal Reserve interest rates and their implications, you can make informed decisions about your finances and investments. Keep an eye on the next FOMC meeting in March 2025 for further insights into the Fed's policy direction.