Today's Mortgage & Interest Rates: In-Depth Analysis, Trends, and Actionable Insights for Homebuyers

Introduction

In the current economic landscape, understanding interest rates mortgages is crucial for anyone navigating the housing market. This comprehensive analysis examines prevailing trends in interest rates today, mortgage rates today, and more.

The article explores recent fluctuations, evaluates factors behind these changes, and offers actionable insights for both homebuyers and homeowners. With data sourced from credible financial institutions such as Investopedia, CBS News, and Forbes, this report provides an evidence-based exploration into terms such as did interest rates go down today, refinance mortgage rates today, and 30-year mortgage rates today.

By integrating historical data with the latest market signals, readers will gain a thorough understanding of the current environment and be equipped to make informed decisions.

Understanding the Basics of Mortgage and Interest Rates

The Concept of Interest Rates Mortgages

Mortgage products are intrinsically linked to broader economic factors, most notably the interest rates today set by the Federal Reserve. Interest rates mortgages reflect not only the cost of borrowing but also signal investor sentiment and economic forecasts. Homebuyers, property investors, and homeowners refinancing their loans are all affected by shifts in these rates.

For example, when the Federal Reserve adjusts the federal funds rate, it triggers a cascade of changes that impact both home interest rates and long-term mortgage interest rates today.

Detailed Analysis of Interest Rates Today

Current Landscape and Data Evidence

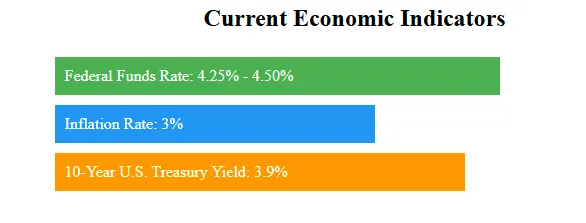

As of March 5, 2025, the prevailing interest rates today reflect a cautious monetary policy. The Federal Reserve has maintained the federal funds rate between 4.25% and 4.50%, following recent adjustments aimed at curbing inflation. Economic statistics indicate that the inflation rate is around 3%—a figure that, despite being above target, has allowed for modest rate cuts. The stability in today's interest rates has been significantly influenced by the bond market, especially the 10-year U.S. Treasury yields, which stand at approximately 3.9%. For more details on these benchmarks, refer to the U.S. Treasury.

Underlying Drivers of Interest Rates Today

Multiple factors play into the current framework:

- Monetary Policy: Driven by the Fed's commitment to balance inflation with growth, the present range of interest rates today reflects controlled measures rather than aggressive hikes or cuts.

- Global Economic Influences: Geopolitical uncertainties and trade policy adjustments continue to affect market expectations, contributing to moderated changes in interest rates drop today.

- Economic Performance: Slower economic growth and steady unemployment rates influence the Fed’s decisions, resulting in a scenario where did interest rates go down today might not reflect drastic overnight changes but gradual movement over weeks.

This continuous adjustment process assures that interest rates dropping remains a carefully monitored aspect of the broader market conditions, providing stability albeit with gradual trends.

In-Depth Examination of Mortgage Rates Today

Current Mortgage Rate Figures

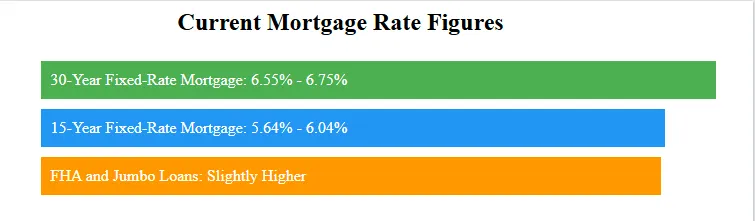

As of the latest reports in early March 2025, mortgage rates today are presenting slightly favourable conditions:

- 30-Year Fixed-Rate Mortgage: Recent reports state an average rate near 6.55% to 6.75% for home purchase loans.

- 15-Year Fixed-Rate Mortgage: The average sits between 5.64% and 6.04%, offering a robust alternative for buyers seeking faster equity accumulation.

- FHA and Jumbo Loans: Programs specifically designed for different market segments are seeing rates that align closely with these averages, though jumbo loans are marginally higher due to increased risk profiles.

These numbers are consistently reported by outlets such as Forbes and CBS News, confirming that mortgage rates today reflect a delicate interplay between market expectations and policy decisions.

Factors Impacting Mortgage Rates Today

Several dynamics impact the rates at which consumers borrow:

- Bond Market Trends: The correlation between the 10-year Treasury yield and mortgage interest rates today demonstrates that as bond yields fall, mortgage rates tend to follow suit.

- Fed Policy & Economic Data: Given the Fed’s stance on inflation control, even minor signals can influence did mortgage rates drop today. The current economic indicators, while supportive of low-rate environments, suggest that significant immediate shifts in today's mortgage rates are unlikely.

- Housing Supply & Demand: Another critical factor is the imbalance between housing inventory and demand. High home prices coupled with limited supply continue to strain overall affordability, highlighting the paradox where even lower interest rates mortgages might not sufficiently address the affordability crunch.

Evaluating the Question: Did Interest

Rates Go Down Today?

Assessing Daily Movements

When analyzing whether did interest rates go down today, the answer is nuanced. Today, as of March 5, 2025, there are no drastic changes. However, incremental improvements are evident, aligning with recent downward trends over the past several consecutive days. The relatively steady nature of today's interest rates suggests that while incremental declines can be seen in select metrics, there is no singular moment when one can definitively state that interest rates drop today in a dramatic fashion.

Factors Contributing to Daily Stability

The stability in interest rate today values is largely due to:

- Monetary Policy Consistency: The Federal Reserve’s cautious approach limits abrupt changes in the market.

- Moderated Economic Signals: While inflation data and employment figures are monitored closely, they have not triggered immediate rate fluctuations.

- Investor Sentiment: Stability in long-term bonds and Treasury yields helps keep mortgage rates from swinging wildly, ensuring that even those with interest rates mortgage considerations enjoy a degree of predictability.

For further insights, refer to analysis on Investopedia.

Analysis of Refinance Mortgage Rates Today

Current Rates for Refinancing

Homeowners looking to adjust their financing choices should note that refinance mortgage rates today are somewhat higher than purchase rates. Average figures include:

- 30-Year Fixed Refinance: Around 7.29% (APR near 7.53%).

- 15-Year Fixed Refinance: Roughly 6.67% (APR near 7.12%).

- Specific Loan Programs (FHA/VA): FHA refinance rates average about 6.55%–6.99%, while VA loans may see rates around 6.17%.

These refinances rates, reported by sources like LendingTree, imply that while there is an opportunity to rework a loan profile, the margins for savings depend greatly on the existing rate on a mortgage. Borrowers with rates significantly above these averages might benefit, whereas those with near-current rates may not.

Comparison Between Purchase and Refinance Rates

Mortgage rates for home purchases tend to be lower than refinance mortgage rates today. For example, while a 30-year mortgage rates today for a new purchase might be around 6.76%, the corresponding refinance rate rises to around 7.29%. This difference is attributed to lender risk assessments which include factors like borrower credit history and the remaining term of an existing mortgage.

Homeowners considering refinancing should evaluate:

- The cost of refinancing relative to the potential savings.

- The impact on the monthly payment and the new loan term.

- Long-term financial goals, such as reducing overall interest payable over the life of the loan.

Further reading on these comparisons is available on Bankrate.

Exploring 30-Year Mortgage Rates Today

Present Figures and Trends

The 30 year mortgage rates today remain one of the most scrutinised metrics in the housing market. As of March 5, 2025:

- Average rates for a 30-year fixed mortgage are recorded between 6.52% and 6.76%.

- This metric is central for many homebuyers due to the balance it offers between monthly affordability and long-term interest costs.

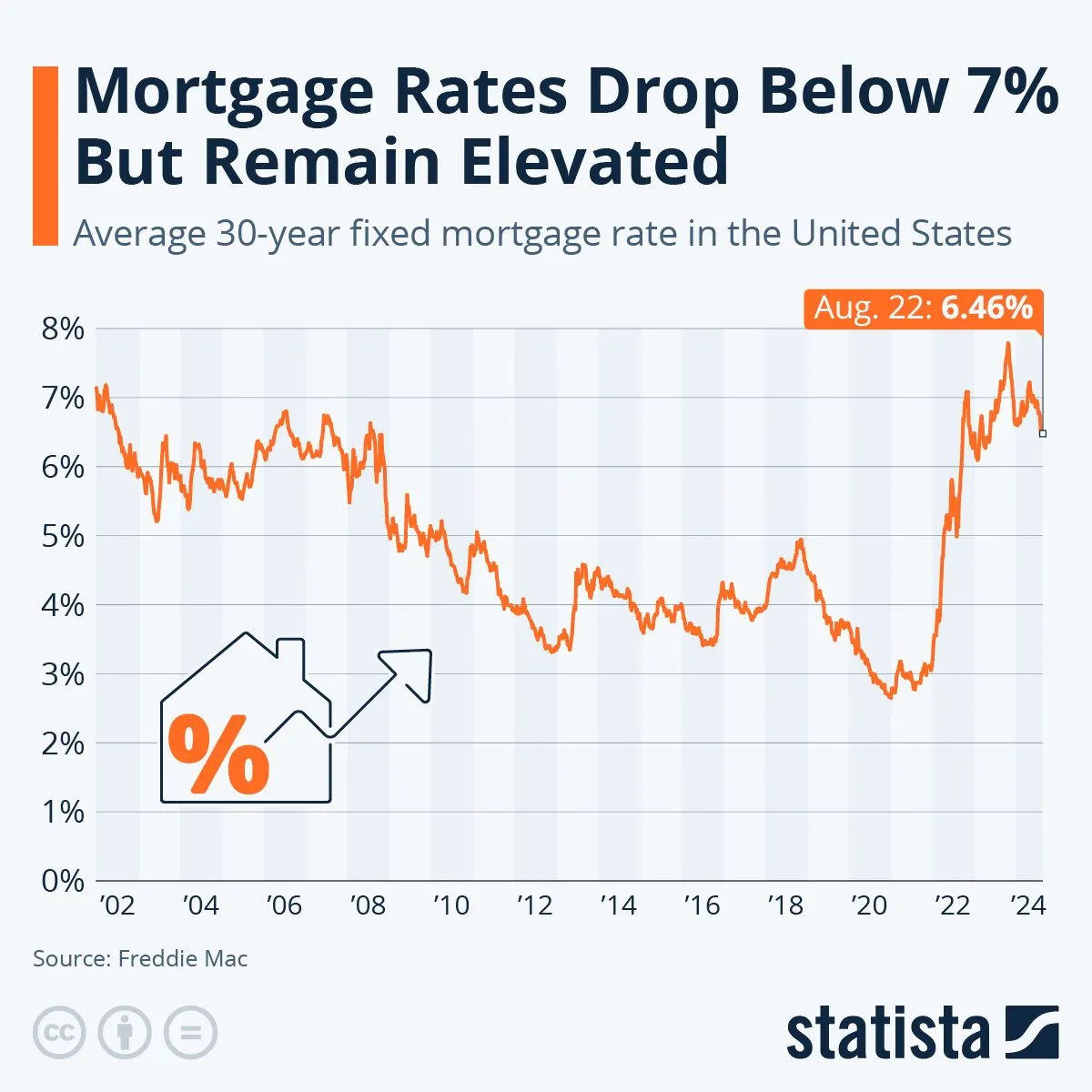

Data from Investopedia and Bankrate indicates that these rates have trended downward since a peak period in late 2023. A comparative glance at historical trends shows that past economic cycles have seen much higher rates, underscoring the relative advantage of today's conditions—even if the market remains challenging.

Historical Perspective and Context

Understanding 30 year mortgage rates today requires contextualising them within broader economic trends:

- During the 1980s, rates soared above 15% due to rampant inflation.

- The 2010s witnessed average rates below 4% amidst economic recovery post-2008.

- In 2020-2021, rates dropped to historic lows, fueled by a combination of low demand and expansive monetary policy.

Today’s rates, while not as low as the pandemic lows, ensure competitive borrowing costs amid a steadily improving economic environment. This context reinforces why even small shifts in these rates—such as a 0.25% drop—can have substantial implications for monthly mortgage costs.

Assessing the Implications for Homebuyers and Homeowners

Impact on Purchase Decisions

For prospective homebuyers, mortgage interest rates today play a pivotal role in affordability. Lower rates result in:

- Reduced monthly mortgage payments, thereby increasing purchasing power.

- Greater accessibility to higher-priced homes as borrowing costs diminish.

- Enhanced long-term financial planning due to predictable debt servicing costs.

For instance, a reduction from 6.76% to 6.52% on a $300,000 loan might save borrowers dozens of pounds monthly, thus justifying a swift decision when rates are favourable.

Considerations for Refinancing

Homeowners with existing mortgages priced at higher rates should evaluate refinance mortgage rates today as a way to reduce interest burdens. However, the decision to refinance must include:

- An analysis of closing costs and fee structures.

- A comparison of current versus potential monthly payments.

- A review of the break-even period, which is the time needed to recoup the refinancing costs through lower payments.

For those with robust equity and stable financial profiles, refinancing can unlock significant savings over the long run. Detailed cost-benefit analyses are available through platforms like Bankrate.

Monitoring Trends: Interest Rates Drop Today and Daily Market Movements

Real-Time Evaluations

Many potential borrowers ask, "did interest rates drop today?" Although drastic daily fluctuations are rare, monitoring intra-day trends can provide insights into market momentum. Today, while there has been no dramatic plunge in today's interest rates, slight movements in benchmark rates are observed. These contribute to the broader narrative of interest rates dropping gradually rather than in sudden spikes.

Market Signals and Economic Indicators

Key economic signals that reinforce these gradual movements include:

- Inflation Data: With inflation hovering around 3%, the impetus for aggressive rate cuts is limited.

- Treasury Yields: Stable 10-year yields at roughly 3.9% indicate that the long-term view of borrowing costs remains moderate.

- Global Market Conditions: Despite some global economic volatility, the internal U.S. market remains largely anchored by consistent monetary policy.

For further clarity on these dynamics, detailed analyses can be reviewed on sources like CBS News.

Comparative Analysis: Home Interest Rates Today and Broader Market Dynamics

Overview of Home Interest Rates Today

Home interest rates converge around similar themes as broader justifications affecting mortgage interest rates today. While consumers often focus on the headline numbers, the underlying components such as credit scores, loan-to-value ratios, and regional variations can create significant differences among borrowers.

Maintaining awareness of home interest rates today is crucial for:

- Understanding the cost of borrowing relative to historical averages.

- Evaluating the true cost of homeownership versus renting.

- Making strategic decisions about whether or not to enter the housing market in the current economic cycle.

Regional Variations and Market Segments

Not every market experiences identical trends. In urban centres with high demand but low inventory, today's mortgage rates might reflect higher premiums due to risk factors. Conversely, in more stable suburban or rural areas, competitive lending strategies can push home interest rates today to more favourable terms. These regional differences underscore the importance of a localized approach in addition to national trends.

For localised data, platforms such as Zillow provide tailored insights based on geographic criteria.

In-Depth Data and Evidence Supporting the Analysis

Statistical Overview

Data from multiple reputable sources present a consistent narrative:

- Investopedia reports that the average 30-year fixed mortgage rate is near 6.55%–6.75%, providing robust evidence for current valuation changes.

- CBS News confirms that the Federal Reserve maintains interest rates today in the 4.25%-4.50% range, reinforcing stability in borrowing costs.

- Forbes and Bankrate together indicate that both mortgage rates dropping today and minor daily rate changes contribute to a long-term trend of gradual improvement.

By integrating historical averages with the most recent data, it becomes clear that while conditions today are better than recent highs, the market remains cautious.

Historical Trends and Contextual Relevance

Reviewing historical data reveals that today's environment is part of a cyclical process. While significant during the 1980s, double-digit interest rates mortgages are now a relic of the past. The modern environment offers more stability:

- The evolution from rates exceeding 15% in some past decades to approximately 6.55%–6.75% today underscores broader economic stabilisation.

- Comparisons with the record lows during 2020–2021 establish that while homeowners might reminisce about lower historical rates, the current market remains attractive if approached with a well-informed strategy.

These insights are valuable to both prospective buyers and current homeowners considering refinancing options.

Actionable Takeaways and Practical Insights

For readers seeking clear recommendations based on this comprehensive analysis, consider the following actionable insights:

- If you are a homebuyer, now is a strategic time to capitalise on relatively lower 30 year mortgage rates today. Evaluate your overall financial health and consider locking in a rate if the market aligns with your long-term goals.

- Homeowners with higher existing rates should research refinance mortgage rates today. Run detailed cost-benefit analyses to ensure that refinancing will result in tangible savings over the life of your loan.

- Keep informed about interest rates dropping trends by monitoring updates from reputable sources such as Forbes and Investopedia. Staying updated is essential since incremental changes can collectively have a significant impact.

- When evaluating whether did interest rates drop today or if did mortgage rates drop today, look at a broader timeframe. Daily fluctuations can be less indicative of long-term trends governing your financial decisions.

- Consider consulting with financial advisors or mortgage specialists to carefully examine personal circumstances, particularly if contemplating refinancing or purchasing in a volatile market.

- Understand that while home interest rates today and current mortgage rates provide useful benchmarks, factors such as local market dynamics and individual credit scores will influence the final loan terms.

Adopting these strategies, complemented by regular reviews of market data from trusted outlets like CBS News and Bankrate can empower you to make decisions that align with both your immediate needs and long-term financial goals.

Extended In-Depth Analysis and Real-Life Examples

Case Study 1: The New Homebuyer’s Perspective

Consider a first-time homebuyer in a competitive metropolitan market. With the mortgage market reflecting today's mortgage rates of 6.76%, the buyer may calculate that even a slight reduction in rate—for instance, from 6.76% to 6.55% on a 30-year fixed mortgage—results in significant monthly savings. Over the loan term, these savings accumulate, reducing the overall cost of homeownership. In such a scenario, locking in a favourable rate based on current interest rates mortgages is not only financially prudent but also strategically advantageous in a market where prolonged, gradual rate declines are expected.

Case Study 2: Refinancing in a Changing Landscape

An established homeowner with an existing mortgage rate of over 7% might find that the posted refinance mortgage rates today of around 7.29% present an opportunity for cost reduction. By refinancing, the homeowner reduces their monthly payments and accelerates equity accumulation. However, due diligence is required to factor in refinancing fees. A thorough discussion with a mortgage lender, combined with external data from platforms like LendingTree, can guide borrowers through the complexities of such a decision.

These examples illustrate how individual circumstances interact with broader market dynamics. Real data and consistent monitoring of interest rates today are imperative for aligning personal financial strategies with market conditions.

Concluding Insights

In summary, today's landscape for interest rates mortgages and mortgage rates today is one of cautious optimism. Although did interest rates drop today might not show a dramatic transformation, gradual and consistent improvements are evident. Potential homebuyers benefit from favourable 30-year mortgage rates today that enhance affordability, while current homeowners are encouraged to evaluate refinancing options given the current refinance mortgage rates today.

Maintaining an informed, data-driven approach is the key takeaway. With reliable sources such as Investopedia, CBS News, and Forbes at your fingertips, you can develop a strategy that navigates evolving economic conditions and secures your financial future. By continuously monitoring today’s interest rates and remaining alert to incremental changes in mortgage interest rates today, you position yourself to take advantage of the opportunities available in a dynamic housing market.