Nvidia Q4 2025 Earnings Report: Unveiling Nvidia Stock Earnings Report Trends, NVDA Performance, and Market Forecasts

Introduction

Nvidia Corporation has once again set the standard in the technology sector by posting stellar financial figures in its Q4 2025 earnings report. This comprehensive report explains how Nvidia has maintained its market dominance, particularly in areas such as artificial intelligence and data centre solutions. The discussion below is designed for investors, analysts, and tech enthusiasts who need an in-depth understanding of the nvidia stock earnings report, NVDA, nvidia stock, nvda stock, and related trends.

Drawing from reliable financial data and reputable sources such as MarketBeat, Investopedia, and Business Insider, this article presents a detailed analysis of Nvidia’s financial performance, stock behaviour, and forward-looking market insights. With an emphasis on accuracy and a wealth of actionable takeaways, every aspect of the report is broken down into strategic subtopics to serve both short-term investors and long-term stakeholders.

Nvidia Q4 2025 Earnings Overview

Financial Performance and Key Metrics

Revenue and Earnings Growth

Nvidia announced a record-breaking revenue of $39.3 billion in Q4 2025. This represents a 12% increase quarter-over-quarter and an exceptional 78% increase year-over-year. The earnings per share (EPS) on a GAAP basis were reported at $0.89, surpassing the consensus estimate of $0.84. Such performance underscores the strength of nvidia in capitalising on burgeoning tech opportunities.

Gross Margins and Production Impact

Nvidia’s gross margins experienced a slight dip, moving from 76% in the previous year to 73% during Q4 2025. However, management has expressed confidence that the margins will improve to mid-70s in upcoming quarters as production efficiencies increase and economies of scale are realised. This metric is crucial for assessing overall financial health, especially as Nvidia scales its innovations in both hardware and software.

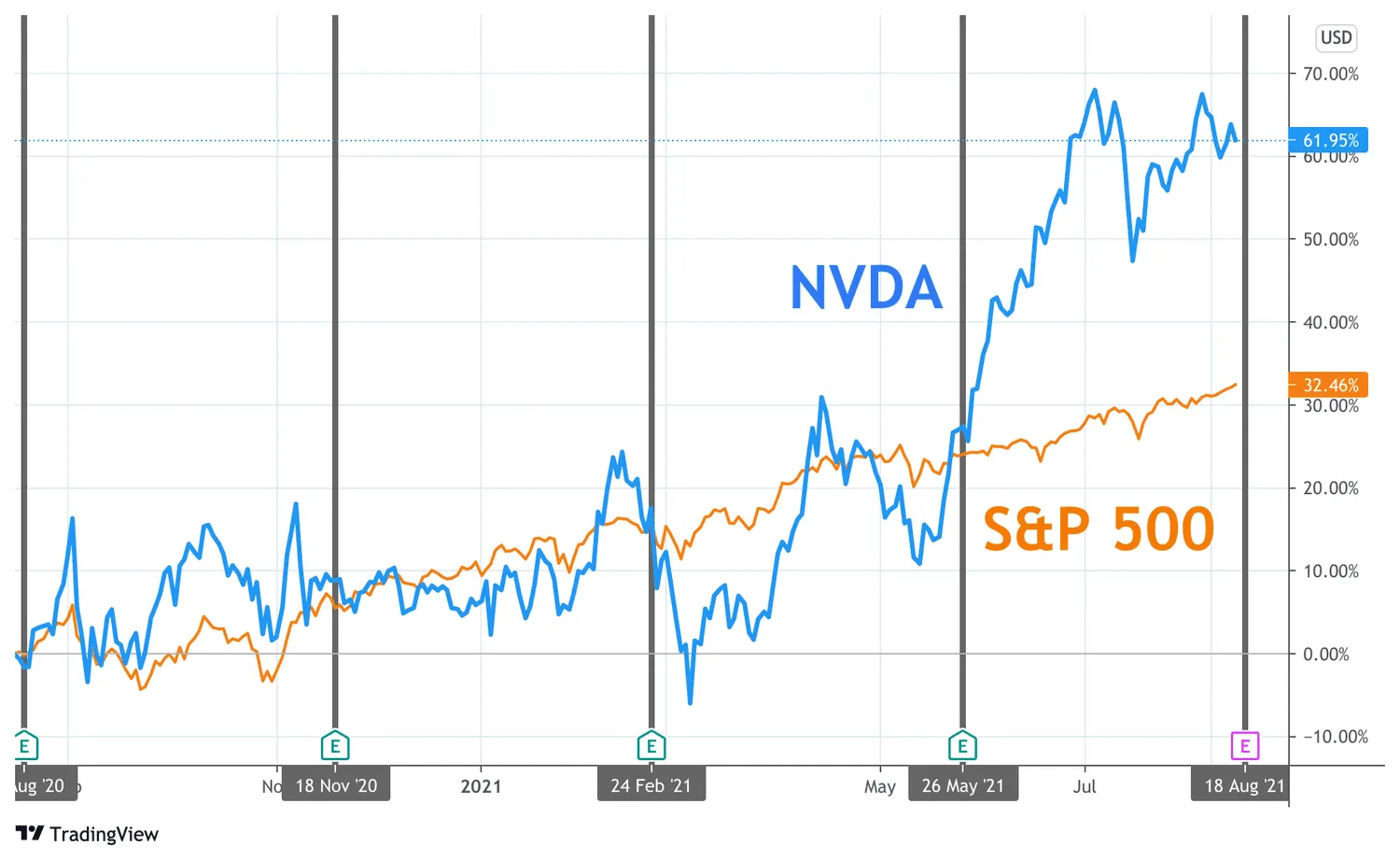

Stock Price Performance

The impressive financial metrics translated into strong market performance for nvidia stock. Immediately following the earnings release, the NVDA stock price surged by 3.67%, closing at $131.28. Although some volatility was reported during after-hours trading, reflecting investor caution about high valuations, the overall sentiment remains bullish.

Key Drivers of Nvidia's Growth

Technological Leadership in AI and Data Centre Solutions

Dominance in Artificial Intelligence

Nvidia has become a linchpin in the AI revolution. The company’s data centre revenue reached an all-time high of $35.6 billion. This boost is primarily due to increased demand for nvidia's AI accelerators and advanced GPUs that power modern machine learning applications. AI trends are reinforced by robust partnerships with industry leaders such as Microsoft, Meta, Amazon, and Alphabet. Their investments in AI infrastructure have significantly bolstered Nvidia’s growth, making its NVDA earnings report pivotal to understanding market dynamics.

Enhanced GPUs and Next-Generation Architectures

The introduction of the RTX 40 series GPUs has propelled Nvidia's capabilities further. These GPUs not only serve traditional gaming markets but also provide essential processing power for professional graphics, creative applications, and scientific research. Nvidia continues to evolve its hardware designs, ensuring the nvidia earnings call discussions reflect innovations that spur demand across multiple sectors.

Strategic Partnerships and Collaborative Innovations

A significant highlight of Nvidia’s Q4 2025 earnings was its strategic alliance with the Chinese startup DeepSeek. This collaboration is aimed at enhancing the performance of Nvidia’s cutting-edge Blackwell chips, which contributed approximately $11 billion to the quarterly revenue. The partnership is framed as a move to further integrate AI models that optimise computational workflows, bridging the gap between hardware performance and software efficiency.

Market Dynamics and Investor Sentiment

Stock Volatility and Investor Confidence

Investor response to the nvidia stock earnings report was generally positive but accompanied by notable after-hours volatility. Such fluctuations are typical in high-growth tech stocks like NVDA due to speculative investments. The stock’s performance signals that while enthusiasm for Nvidia’s future remains high, investors are carefully monitoring valuation metrics and forward guidance.

Analyst Forecasts and Market Expectations

Market analysts have projected a continued bullish outlook on nvidia stock. Several experts predict that, given the current trajectory, the stock could witness a double-digit increase this year. Despite these positive forecasts, some analysts have warranted caution, especially considering the transient nature of tech-sector exuberance. The consensus remains that the company’s strong fundamentals and innovative pipeline offer promising long-term potential, even as short-term market adjustments occur.

Deep Dive: Nvidia's Strategic Initiatives and Product Innovations

AI Innovation and Next-Generation Tech

Nvidia’s AI Ecosystem

Central to Nvidia’s strategy is its robust focus on AI. The company’s suite of AI tools underlines its commitment to evolving beyond conventional graphics processing. Nvidia’s AI applications are employed in autonomous vehicles, robotics, healthcare, and more – underscoring the diversified applications of nvidia stock earnings report narratives. These innovations help bridge the digital ecosystem, driving both operational efficiencies and breakthrough applications.

Jensen Huang’s Vision for AI

At the heart of Nvidia’s success story is CEO Jensen Huang. His forward-thinking vision has steered the company towards pioneering AI technologies that meet global demand. Huang’s regular updates during the nvidia earnings call provide valuable insights into the company’s strategic roadmap. His emphasis on integrating hardware with advanced software platforms has positioned Nvidia as a transformational leader in technology.

Data Centre Optimisation

Emerging technologies in cloud computing and data analytics heavily rely on Nvidia’s advanced GPU architectures. Nvidia’s data centre segment not only promises robust revenue growth but also ensures that the company remains a critical enabler in data-driven economies. The significance of high-performance computing cannot be overstated when assessing the broader context in which nvda stock price fluctuations occur.

Consumer and Gaming Segments

Bridging Professional and Gaming Markets

Nvidia’s product portfolio extends beyond the data centre and AI applications. The nvidia stock price has been positively impacted by its diverse offerings across consumer and professional segments. The RTX series of GPUs, noted for their superior performance in gaming and virtual reality, have cultivated a loyal clientele among gamers and creative professionals. This diversification reinforces Nvidia’s market positioning, ensuring that its revenue streams remain resilient even as it faces competitive pressures.

Emergence of Hybrid Markets

The integration of gaming, creative digital applications, and computational research is creating hybrid market segments where multiple industries converge. This synergy between consumer technology and professional-grade hardware has contributed to the robust performance reported during the nvda earnings call. It highlights how Nvidia is uniquely poised to benefit from cross-sector growth.

In-Depth Analysis of Nvidia’s Stock Behaviour

Earnings Call Dynamics and Timing

What Time is Nvidia Earnings Call?

For investors and market watchers, pinpointing the timing of the nvidia earnings call is critical for real-time decision-making. Discussions usually take place in the late afternoon, aligning with post-market analysis sessions when data and commentary are most informative. Queries such as “what time does nvidia report earnings” are common among stakeholders eager to minimise information asymmetry.

Detailed Breakdown of Calling Procedures

A typical NVDA earnings call involves a presentation of quarterly financials, followed by a Q&A session where analysts probe the management on performance drivers, future forecasts, and competitive positioning. These calls offer granular insights, especially to those tracking nvda earnings time and nvidia earnings call today statistics, making them integral components of the overall report evaluations.

NVDA After Hours Trading

After Hours Dynamics

Following the initial market reaction during the standard trading hours, NVDA after hours trading sessions provide critical signals about market sentiment. These sessions can be particularly volatile; for instance, after-hours fluctuations in nvda stock price mirror investors’ immediate interpretations of the earnings data and forward guidance.

Historical Trends in After Hours Movements

Historically, Nvidia has seen significant movements in after-hours trading, mirroring overall market sentiment towards tech stocks and AI-related news. Analysts often cite after-hours data as an early indicator of the stock’s performance trajectory. For example, tracking nvda after hours trends provides investors with context as to whether the positive earnings have been fully priced into the market.

Market Comparisons and Competitive Landscape

Nvidia in the Context of Tech Industry Rivals

How Does Nvidia Compare to Its Peers?

Within the semiconductor and AI hardware space, Nvidia holds a dominant position with few superior competitors. Companies like AMD and Intel strive to capture market share, yet Nvidia’s specialised focus in high-performance GPUs and AI-driven solutions consistently keeps nvda stock earnings in the spotlight. Analysts closely monitor competitors’ results alongside nvidia earnings report metrics to contextualise Nvidia's sustained performance.

Competitor Analysis and Market Share

While the nvidia stock performance has been robust, understanding competitor moves is essential. Recent comparisons suggest that Nvidia’s R&D expenditure and innovative product launches continue to outpace industry peers. This competitive edge is reflected in each quarter’s earnings presentation, as well as in investor sentiment regarding nvidia stock price trends.

Investor Concerns and Opportunities

Risk Analysis and Valuation Concerns

Investors remain cautious despite Nvidia’s enviable track record. The high valuation of $NVDA stock often triggers debates about whether current prices have factored in all future growth prospects. Concerns over oversaturation in the tech market and global supply chain disruptions occasionally surface but are largely tempered by Nvidia's robust financial foundations and strategic vision.

Opportunities for Long-Term Holders

For long-term investors, the balance of risk and reward remains favourable. Nvidia’s consistent commitment to innovation – as showcased by frequent updates during nvda earnings live sessions – provides a compelling case for enduring growth. Keeping close watch on nvda earnings report details and nvidia news updates ensures that investors can make informed decisions about entering or expanding positions in the stock.

Data-Driven Insights and Evidence

Evaluating Nvidia’s Financial Metrics

Revenue Growth Trends

Analyzing Nvidia’s quarterly revenue data reveals a consistent upward trajectory. The leap to $39.3 billion in revenue demonstrates how well Nvidia has executed on increasing its market penetration across various segments. Comparing these numbers with previous quarters and historical data accentuates the impact of its AI and data centre initiatives.

Earnings Per Share Analysis

The EPS of $0.89 not only surpassed market expectations but also positioned Nvidia favourably relative to its peers. This metric, which is a critical indicator of profitability, reflects careful cost management and efficient capital allocation. Such an emphasis on real numbers adds credibility to the nvidia earning analysis and reinforces the stock's potential for long-term growth.

Gross Margin Considerations

A slight dip in gross margins to 73% might be observed at first glance, yet this is consistent with expansion strategies where short-term contractions yield long-term benefits. Nvidia’s proactive measures to restore margins through increased production capacity and innovation investments are projected to restore profitability metrics in subsequent quarters.

Historical Trends and Data Comparisons

Quarterly Comparisons and Year-over-Year Growth

Evaluating historical data from previous earnings cycles sheds light on the remarkable growth path for nvda stock. The year-over-year comparison, showcasing a 78% revenue jump, is indicative of market dynamics shifting in favour of tech and AI investments. These trends are bolstered by episodic announcements from major tech firms and consistent rallying support during nvidia earnings live sessions.

Statistical Projections and Analyst Forecasts

Expert projections for Q1 2026 and beyond have been optimistic, indicating potential for further nvidia stock earnings improvements. Statistical models, drawing on historical performance and macroeconomic factors, support a sustained upward trend. Such evidence-based projections are instrumental in building confidence among stakeholders and serve as a testament to Nvidia’s market resilience.

Future Outlook: Innovations and Strategic Roadmap

Nvidia’s Innovation Pipeline

Anticipated Product Launches and GTC Announcements

Looking towards the future, Nvidia’s roadmap includes expected breakthroughs in GPU architectures and generative AI solutions. The upcoming GPU Technology Conference (GTC) in March 2025 is anticipated to be a major event where Nvidia unveils next-generation technologies that could further revolutionise how industries utilise data and computing power. Keeping an eye on such events is crucial, as they provide early insights into potential shifts in nvda stock news today.

Expanding Into New Markets

Nvidia is not solely reliant on traditional markets. The company is actively exploring breakthroughs in autonomous vehicles, edge computing, and even healthcare applications. By diversifying its applications and integrating these advanced systems, Nvidia continues to widen the avenues through which NVDA stock may benefit from long-term market trends.

Long-Term Strategic Vision and Jensen Huang’s Leadership

The Role of Executive Leadership

CEO Jensen Huang remains the visionary behind Nvidia’s continued success, orchestrating strategic initiatives that leverage cutting-edge technologies. His periodic discussions during the nvda earnings call offer invaluable context on Nvidia's strategic priorities, including enhanced focus on R&D and global expansion. Such leadership fosters investor trust and supports the narrative across the nvidia earnings report discourse.

Market Expansion and Global Impact

Nvidia’s ambition is not limited to established markets. With concerted efforts towards penetrating untapped regions and sectors, the company is laying the groundwork for sustained global influence. As discussions around nvda ticker continue in financial circles, Nvidia's ability to maintain competitive differentiation remains a core pillar for its long-term value proposition.

Actionable Takeaways

Key Insights for Investors and Stakeholders

Monitor AI and Data Centre Growth

The AI revolution and the increasing reliance on advanced data centre solutions provide the primary catalysts for Nvidia’s growth. Investors should focus on developments in these segments as they are directly linked to the performance of NVDA stock.

Stay Informed on Earnings Call Insights

Critical information emerges from nvidia earnings call details and subsequent Q&A sessions. These events offer granular insights into management’s plans and upcoming innovations, serving as invaluable resources for timely decision-making.

Evaluate Multi-Sector Opportunities

With Nvidia’s diversified approach that spans gaming, professional visualization, and AI, stakeholders are encouraged to evaluate the company’s performance in a broader context. Assessing trends in the nvidia stock price against competitors and across different technological sectors can inform more comprehensive investment strategies.

Capitalise on Strategic Partnerships

Partnerships—such as the collaboration with DeepSeek—demonstrate Nvidia’s proactive approach to integrating advanced AI solutions with its proprietary technology. Investors should consider such strategic alliances when assessing long-term growth potential.

Next Steps and Further Resources

For those interested in diving deeper into Nvidia’s financial performance and strategic direction, monitoring key events such as the GPU Technology Conference (GTC) and regular analysis of quarterly earnings reports is essential. Additional resources, including updates on nvda earnings live and comprehensive market reviews from platforms like MarketBeat and Investopedia, provide valuable context and ongoing data insights.

Conclusion

Nvidia’s Q4 2025 earnings report stands as a critical milestone in the company’s journey as a tech innovator. With record-breaking revenue, robust performance in data centre and AI segments, and astute guidance for the future, the report casts Nvidia as a frontrunner in both market performance and technological advancement. Emphasising strong leadership under Jensen Huang, successful strategic partnerships, and a diversified product portfolio, Nvidia not only reaffirms its market position but also paves the way for upcoming innovations that promise to propel nvda stock earnings to even greater heights.

For investors, analysts, and tech enthusiasts alike, the detailed insights provided herein offer clear guidance on recognising market trends and grasping the potential underlying Nvidia’s success. Embracing a data-driven approach while staying informed on strategic developments is crucial for anyone seeking to capitalise on the transformative shifts driving technology and finance today.