The Expanding Scope of US Tariff Threats and Their Economic Implications

The US Tariff, under President Trump's administration, has already implemented or threatened tariffs on imports from Canada, Mexico, and China. However, the scope of these potential trade actions extends to additional countries and trading blocs, with significant implications for both the domestic and global economy.

Economic analyses suggest these tariffs would create short-term inflationary pressures while reducing long-term economic growth, despite generating substantial federal revenue. This comprehensive assessment examines the expanded targets of US tariff threats and analyzes their projected economic impact across different timeframes.

US Tariff Targets Beyond North America and China

Beyond the well-publicized tariffs targeting North American neighbors and China, the European Union stands as the most prominent additional entity facing potential trade restrictions from the United States. President Trump has directly indicated that tariffs on EU goods imported into the US could happen "pretty soon," criticizing what he perceives as unfair trade practices3. He specifically complained that the EU "don't take our cars, they don't take our farm products, they take almost nothing and we take everything from them. Millions of cars, tremendous amounts of food and farm products"3.

The European Union, a 27-member trading bloc, represents one of America's largest trading partners and would face significant economic disruption from any new tariff regime. According to economic modeling from the Tax Foundation, the administration is considering implementing a sweeping 25 percent tariff on all imports from the European Union4. This would represent a substantial escalation in global trade tensions, potentially affecting hundreds of billions of dollars in transatlantic commerce.

The United Kingdom, despite having left the European Union, has also been mentioned in President Trump's tariff discussions, though with a notably different tone. While describing the UK as "out of line" on trade matters, Trump expressed optimism that trade issues with Britain "can be worked out"3. This suggests the possibility of a differentiated approach to the UK compared to the EU, potentially reflecting the "special relationship" between the two nations or strategic considerations regarding post-Brexit trade agreements.

Trump noted his positive relationship with British Prime Minister Sir Keir Starmer, stating, "We've had a couple of meetings. We've had numerous phone calls. We're getting along very well"3.

Beyond specific countries, the Trump administration is also considering sectoral tariffs that would affect global trade partners regardless of origin. These include expanded steel and aluminum tariffs, which would end country exemptions for existing steel and aluminum derivatives tariffs and increase tariff rates on aluminum from 10 percent to 25 percent4.

Additionally, a proposed 25 percent tariff on automobiles would target motor vehicles and motor vehicle parts under specific HTS codes, affecting approximately $286.2 billion worth of imports based on 2024 figures4.

Short-Term Economic Consequences of Comprehensive Tariffs

The immediate economic consequences of implementing a comprehensive tariff regime across multiple countries would be significant and multifaceted, with inflation emerging as the most prominent short-term concern. According to macroeconomic analysis, higher import tariffs consistently lead to higher inflation in the short term as businesses pass increased costs to consumers2.

This inflationary pressure comes at a particularly challenging time for the US economy, which is already struggling with persistent inflation. Recent data shows wholesale prices jumping 3.5% and consumer prices rising 3% over the past twelve months, rates that exceed the Federal Reserve's targets1.

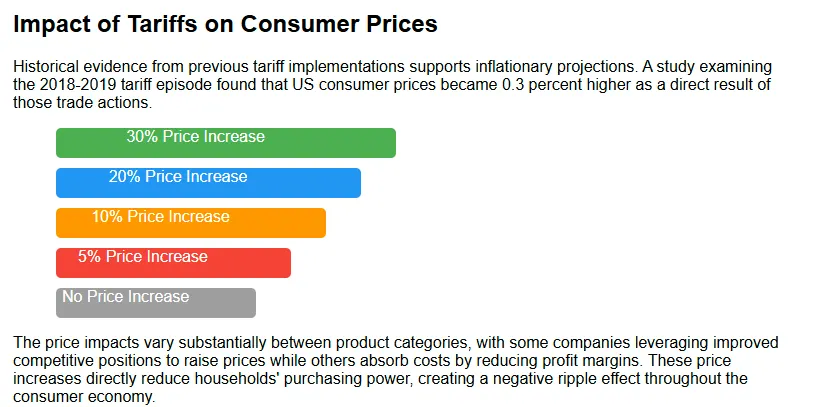

Historical evidence from previous tariff implementations supports these inflationary projections. A study examining the 2018-2019 tariff episode found that US consumer prices became 0.3 percent higher as a direct result of those trade actions2. The price impacts tend to vary substantially between product categories, with some companies leveraging improved competitive positions to raise prices while others absorb costs by reducing profit margins2. These price increases directly reduce households' purchasing power, creating a negative ripple effect throughout the consumer economy.

For businesses dependent on imported inputs, cost structures would immediately deteriorate. American companies integrated into global supply chains would face higher production costs, potentially making them less competitive both domestically and internationally2. These disruptions would be particularly acute for industries with complex international supply networks, where even small cost increases can significantly impact final product pricing and availability.

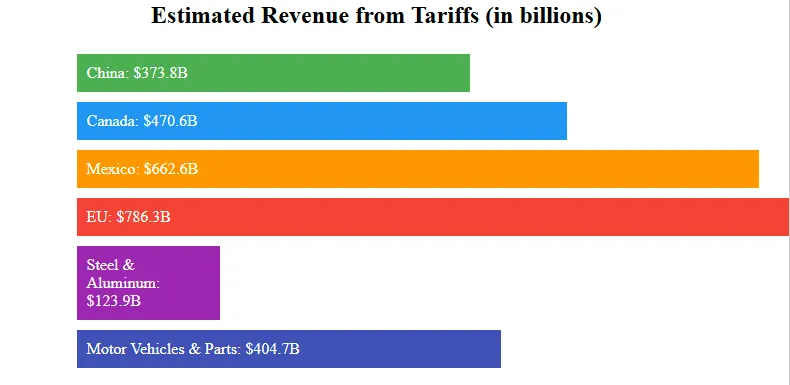

The federal government would experience an immediate increase in revenue from tariff collection. Tax Foundation modeling estimates substantial conventional revenue generation over ten years: $373.8 billion from China tariffs, $470.6 billion from Canada tariffs, $662.6 billion from Mexico tariffs, $786.3 billion from European Union tariffs, $123.9 billion from expanded steel and aluminum tariffs, and $404.7 billion from motor vehicle and parts tariffs4.

However, these figures represent static analysis that doesn't account for behavioral changes or economic contraction.

Long-Term Economic Impact of Widespread Tariffs

While tariffs generate immediate revenue and may temporarily boost specific protected industries, their long-term economic effects are predominantly negative according to both theoretical models and empirical studies. The comprehensive implementation of tariffs across multiple trading partners would create structural changes in the US economy with lasting consequences for growth, employment, and capital formation.

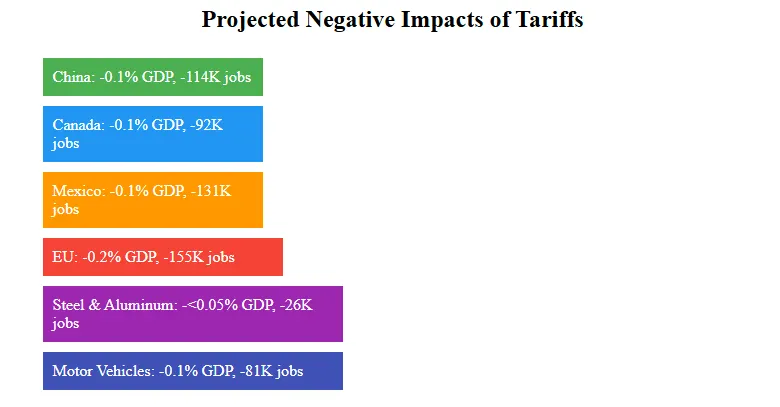

The Tax Foundation's General Equilibrium Model projects specific negative impacts for each proposed tariff package. China tariffs would reduce long-run GDP by 0.1 percent, capital stock by 0.1 percent, and eliminate approximately 114,000 jobs4. Canada tariffs show similar GDP and capital stock reductions while costing 92,000 jobs4. Mexico tariffs would reduce GDP and capital stock by 0.1 percent while eliminating 131,000 jobs4. European Union tariffs present the most significant negative impact, reducing GDP by 0.2 percent, capital stock by 0.1 percent, and eliminating 155,000 jobs4. Expanded steel and aluminum tariffs would have smaller but still negative effects (less than 0.05 percent GDP reduction and 26,000 jobs lost), while motor vehicle tariffs would reduce GDP by 0.1 percent and eliminate 81,000 jobs4.

When considering these tariffs collectively, the cumulative economic impact would likely exceed the sum of their individual effects due to compounding interactions throughout the economy. The capital stock reductions are particularly concerning for long-term growth prospects, as they represent decreased investment that would otherwise enhance productivity and future economic capacity.

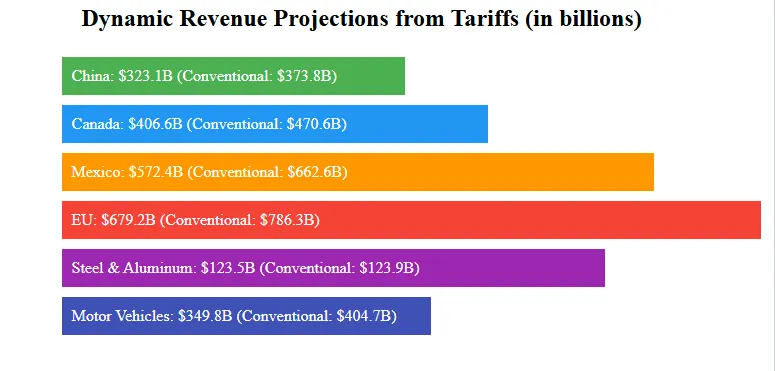

Revenue projections reflect these negative growth implications. The dynamic revenue analysis, which accounts for economic contraction, shows substantially lower revenue than conventional static estimates: $323.1 billion from China tariffs (versus $373.8 billion conventional), $406.6 billion from Canada tariffs (versus $470.6 billion conventional), $572.4 billion from Mexico tariffs (versus $662.6 billion conventional), $679.2 billion from EU tariffs (versus $786.3 billion conventional), $123.5 billion from expanded steel/aluminum tariffs (versus $123.9 billion conventional), and $349.8 billion from motor vehicle tariffs (versus $404.7 billion conventional)4. These differences highlight how economic contraction reduces the revenue-generating potential of tariffs.

The long-term negative effects occur through several economic mechanisms. Higher input costs reduce profitability and production capacity across multiple sectors. Consumer purchasing power diminishes due to higher prices, reducing demand throughout the economy. Investment decreases as returns on capital fall, limiting future productivity improvements. Employment suffers both from direct trade impacts and from broader economic contraction4.

Global Retaliation and Secondary Effects

A comprehensive assessment of tariff impacts must account for retaliatory measures by affected trading partners, which can substantially magnify economic damage. Historical patterns suggest that targeted countries typically respond with countermeasures designed to protect their own economic interests and create political pressure for policy reversal.

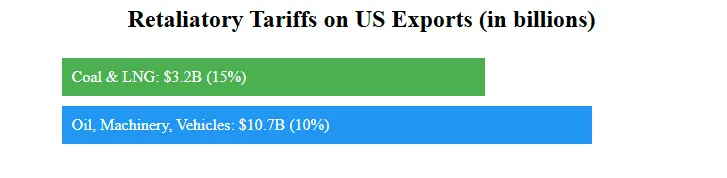

China has already announced retaliatory tariffs on approximately $13.9 billion worth of US exports. These include a 15 percent tariff on US exports of coal and liquefied natural gas (totaling $3.2 billion in 2024) and a 10 percent tariff on exports of oil, agricultural machinery, and large motor vehicles (totaling $10.7 billion in 2024)4. While currently limited in scope, these countermeasures demonstrate China's willingness to respond proportionally to US trade actions.

The European Union has explicitly warned that it will "respond firmly" if targeted with new tariffs3. Given the EU's economic size and political cohesion, its retaliatory capacity should not be underestimated. The bloc has previously demonstrated sophisticated targeting of politically sensitive US exports in response to Section 232 steel and aluminum tariffs.

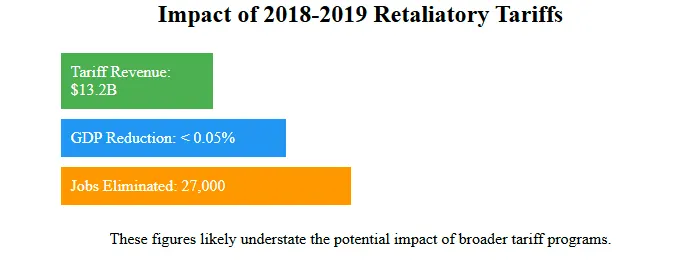

Previous retaliatory tariffs from the 2018-2019 trade conflict period generated approximately $13.2 billion in tariff revenue for foreign governments while reducing US GDP and capital stock by less than 0.05 percent and eliminating 27,000 full-time equivalent jobs4. These figures, while significant, likely understate the potential impact of retaliation to a much broader tariff program targeting multiple major trading partners simultaneously.

Currency market responses represent another important secondary effect. Historical episodes suggest that tariffs often trigger exchange rate adjustments, with the US dollar potentially strengthening as a counterbalancing force2. While a stronger dollar might partially offset price increases for US consumers, it would simultaneously make American exports less competitive globally, creating additional pressure on US manufacturers selling internationally4.

This exchange rate effect could partially neutralize any intended benefits for domestic producers from import protection.

Economic Expert Consensus and Historical Precedent

The economic assessment of tariffs' impact benefits from both historical evidence and expert consensus, both of which point to negative outcomes from widespread trade restrictions. Historical studies consistently show that tariffs raise prices and reduce available quantities of goods and services for businesses and consumers, resulting in lower income, reduced employment, and lower economic output4.

Surveys of economic experts reveal overwhelming skepticism about tariff benefits. A March 2018 Chicago Booth survey of 43 economic experts found that zero percent thought US tariffs on steel and aluminum would improve Americans' welfare4. This unanimity among economists is relatively rare and reflects strong theoretical and empirical foundations.

The disproportionate employment effects across sectors particularly undermine the job-creation rationale for tariffs. A February 2018 analysis found that steel-consuming jobs outnumber steel-producing jobs by a ratio of 80 to 1, suggesting job losses in downstream industries would far outweigh gains in protected sectors4. This imbalance highlights how concentrated benefits for specific industries can be overwhelmed by diffuse but cumulatively larger costs spread throughout the economy.

The International Monetary Fund's research adds further evidence, finding that unexpected tariff shocks tend to reduce imports more than they boost exports, resulting in trade deficits that may persist rather than narrow4. This contradicts the stated goal of using tariffs to address trade imbalances.

Conclusion

The United States' tariff threats extend beyond Canada, Mexico, and China to encompass the European Union, with potential differentiated treatment for the United Kingdom, alongside expanded sectoral tariffs affecting global trade partners. The evidence from economic modeling, historical episodes, and expert analysis consistently indicates that implementing this comprehensive tariff regime would generate short-term inflation while reducing long-term economic growth.

In the immediate term, tariffs would raise consumer prices, disrupt supply chains, and generate federal revenue. Over the longer horizon, they would reduce GDP, decrease capital investment, and eliminate hundreds of thousands of jobs across the economy. These direct effects would likely be compounded by retaliatory measures from trading partners and currency market adjustments that could further harm US exporters.

While proponents argue tariffs will protect domestic industries and generate government revenue, the broader economic evidence suggests these benefits would be outweighed by widespread costs throughout the economy. The potential implementation of this expanded tariff program represents one of the most significant shifts in US trade policy in decades, with far-reaching implications for both domestic economic conditions and America's position in the global trading system.